Yesterday, Chancellor Philip Hammond delivered his first Autumn Statement, detailing his fiscal plan for the near future. While housing featured heavily in the strategy, Hammond should have addressed Stamp Duty, insists a leading online estate agent.

Hammond focused on easing the current housing crisis in his first address, including measures to deliver a property market that works for everyone.

However, eMoov.co.uk believes that little has changed in terms of the message being delivered during the Autumn Statement and insists that Hammond was wrong to leave Stamp Duty out.

Housing market boost

Commenting on yesterday’s Autumn Statement, the Founder and CEO of eMoov, Russell Quirk, says: “The main headline where today’s Autumn Statement is concerned is yet another cash injection for the beleaguered UK property market, with Mr. Hammond pledging £2.3 billion for infrastructure to support 100,000 new homes and £1.4 billion to build 40,000 more affordable houses in the places they are most needed, plus a further boost to Right to Buy.

Hammond Should Have Addressed Stamp Duty, Insists eMoov

“Talk is cheap, even if the numbers being bandied about today are not. And it remains to be seen how the announcement and the money will actually lead to more houses being built in practice.”

He continues: “Mr. Hammond must forgive the nation for welcoming this announcement with a degree of scepticism, as, like many a chancellor before him, these words often equate to little more than regurgitated rhetoric and a shortfall of 100,000 new homes a year.

“The Government must realise that these announcements are all well and good, but it isn’t the funding that is the issue and, until they address the mechanism itself, little will come of it. Where is the land going to come from? How will the planning process be expedited? These are all questions that need answers with actions, not just words, if the current crisis is to be tackled head on.”

Tenant referencing fees ban

He discusses the letting agent fee ban, also announced during the Autumn Statement: “Today’s announcement on rental fees is nothing more than opportunistic tokenism and, surprisingly, is stolen straight from Labour’s manifesto. Interestingly, the Chancellor’s own Housing Minister, Gavin Barwell, described banning lettings fees as ‘a bad idea’ as recently as September.

“It is ironic that the Government should be turning its guns again on the private rental sector, given that the absence of Government action in building affordable homes to rent in the social housing sector has led to private landlords having to fill the gap on their behalf.”

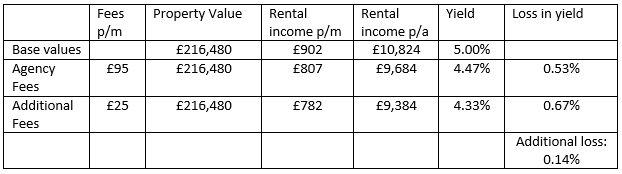

He explains: “A ban on tenancy referencing fees is great on the face of it, but the reality is that the agent will make their money regardless, and this will be passed onto the landlord and in turn the tenant through higher rents.

“We’ve seen the same thing happen in Scotland, whereby the landlord must charge more to the tenant in rent to cover the increase charged by the agent. You would think the Government would have known this.”

Stamp Duty

But while the Chancellor may have addressed certain issues facing aspiring homeowners, he missed the chance to make vital changes to the Stamp Duty system, believes Hammond.

“More of a Stamp Duty refrain, rather than a Stamp Duty reform, by Mr. Hammond today. Stamp Duty is an archaic tax and one that the industry has been crying to be changed in a manner than benefits UK buyers.

“Rather than penalise struggling UK buyers, the Government needs to flip Stamp Duty on its head and make the seller accountable for paying it. This would help those buyers already paying the price of homeownership, whilst those that have benefitted from the appreciating price of their property are in a better position to stomach the sour taste of Stamp Duty tax.”