Rent rises fall, but ban on fees will see them pushed upwards

The latest data released by the Association of Residential Letting Agents has revealed that during October, rent increases fell to their lowest since last December.

However, the falls are not predicted to last for very long, given the decision to ban letting agent fees announced in last week’s Autumn Statement.

Rent rise falls

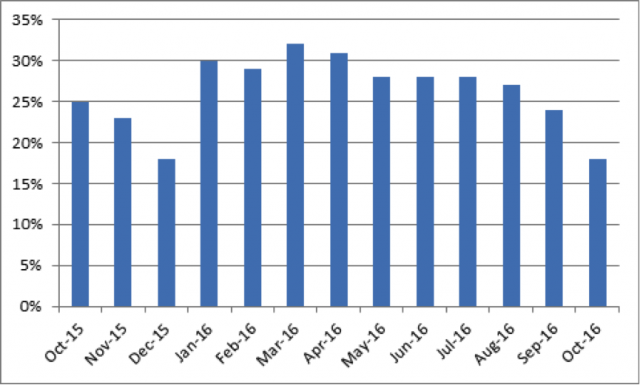

According to the figures, the number of letting agents experiencing rent rises for tenants was at the lowest since December 2015. Only 18% saw rent rises in October, down from the 24% recorded in September. In addition, this will well down on the 32% seen in March.

The table below indicates the percentage of agents seeing rent hikes for tenants over the last year:

Rent rises fall, but ban on fees will see them pushed upwards

Supply

During October, the number of rental properties managed per branch was 180. This was a significant drop from September, when a record 193 properties were managed per branch. What’s more, this was the lowest level seen since June, when there were an average of 176 properties per branch.

Demand from would-be tenants also fell during October, with 34 registered per branch, down from 40 in September.

David Cox, Managing Director at ARLA, said: ‘Just when rents were starting to stabilise, the Chancellor has thrown the biggest curve ball, meaning that rents will unpreventably rise when the tax changes and letting fees ban come into effect. In terms of supply and demand, this month’s findings reflect seasonal expectations and show the market is slowing in the final quarter. With fewer properties available to rent and a drop in the number of prospective tenants registering interest, tenants tend to stay in their current properties until the New Year arrives.’[1]

[1] http://www.propertyreporter.co.uk/landlords/arla-letting-agent-fee-ban-will-speed-up-rent-hikes.html