The Help to Buy Scheme’s Impact Across England Revealed

BBC News has analysed the impact of the Help to Buy scheme across England, particularly in London, following the release of official figures.

The study found that one in three new build homes outside London were bought through the Help to Buy Equity Loan scheme between April 2013 and April 2016, while just one in ten were purchased in the capital.

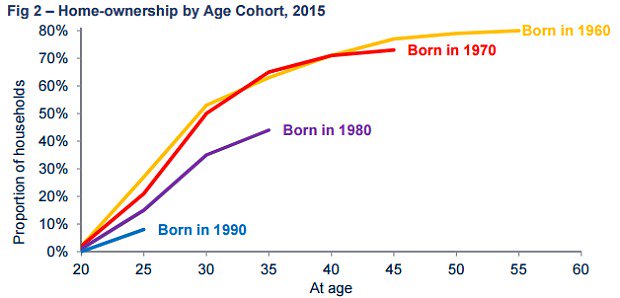

The Help to Buy scheme was introduced to boost the housing market by getting first time buyers onto the property ladder.

A property expert believes the scheme has had “little success” in London, where, in some cases, loans of up to £190,000 have been taken out.

The Government reports that it has helped buyers purchase more than 100,000 homes across England.

To assess the impact of the scheme, BBC England has analysed official figures from the Department for Communities and Local Government. It found:

- Help to Buy loans were used to purchase 76,559 homes outside of London between April 2013 and April 2016. This is equivalent to 30% of the 255,960 privately built new homes completed in that period.

- In London, there were 4,483 completions using equity loans, equivalent to 11% of the 41,480 privately built new properties over the same timeframe.

- Taking all households into account, less than one in every 500 London homes were bought using a Help to Buy loan, compared with one in every 200 elsewhere in England.

- There was a surge in uptake of the loans in Greater London since February 2016, when the Government increased the upper limit for new homebuyers in the capital from 20% to 40% of the property’s value.

The Help to Buy Scheme’s Impact Across England Revealed

Just ten equity loans had been taken out in the London Borough of Hammersmith & Fulham by October 2016 since their introduction in 2013, with buyers receiving £1.9m between them, or an average of £190,000 each.

Six of these buyers were helped between June and September 2016 alone, suggesting that the rise in the upper limit made a massive difference.

In Kensington and Chelsea – the most expensive place to live in the country – the only two loans taken out were worth a combined £360,000.

The highest number of loans taken out per head of population was in Bedford, where the 1,268 loans were equivalent to two in every 100 households. Between them, the loans came to £62.9m, or £49,416.68 each.

The average loan in England, including London, was worth £46,301.03.

Take-up rate in London

The BBC expresses concerns over the rate of take-up in London, which is significantly lower than in the rest of England.

Henry Pryor, a property agent and housing market commentator, warned that there could be a “severe hangover” once the subsidies of Help to Buy are removed.

He says: “The Help to Buy initiatives have been more helpful away from the South East, where prices are lower. Clearly, there is less practical opportunity in London, which is one reason why the numbers here are so small. Even the capital’s own version (with a higher upper loan limit of 40%) has had little success.”

He said the schemes had “clearly helped politically and practically”, but added: “The question is whether the Government can wean lenders and developers off the financial drug that it has become addicted to.

“Watching commercial businesses [housebuilders and developers] get fat on taxpayer subsidies is not something that can or perhaps should last forever. At some stage, we will need to remove the punchbowl and, when that happens, the hangover may be severe.”

Roger Harding, the Director of Communications, Policy and Campaigns at Shelter, also comments: “While a Help to Buy equity loan might help some first time buyers onto the ladder, in the short-term, there is a risk it will push up house prices, making it even tougher for others to buy a home in the future.

“If the Government really wants to tackle our housing shortage, its best bet is to start with building homes that are genuinely affordable for people in low to average incomes to buy and rent long-term.”

Housebuilders, however, insist that the Equity Loan scheme has helped first time buyers who would not otherwise have been able to purchase a home.

Gavin Stewart, the Sales Director at Barratt London, said it had proved an “effective way for many Londoners to get on the property ladder”.

Luke Smith and Barbara Antkowiak, who bought a Barratt London home in Hendon with a Help to Buy loan, says it means they spend less than they would on rent.

Smith says: “We’re hoping that by the time we come to pay it off, the house will have gained enough in equity.”

A spokesperson from the Department for the Communities and Local Government, reports: “Help to Buy equity loans have helped more than 100,000 households get on the housing ladder since it was launched in 2013. It is one of a number of housing schemes provided by the Government, so people have a choice of what is right for them.”

There is little evidence that the scheme is pushing up house prices, they add.

The Department claims that London Help to Buy is “performing strongly” and has seen take-up double since the upper limit was raised in February 2016.

Do you believe the impact of the scheme has been positive?