Home » Uncategorised »

Even Conservative MPs Cannot Afford a Home

This article is an external press release originally published on the Landlord News website, which has now been migrated to the Just Landlords blog.

A Conservative MP has spoken out about his struggles to buy a home after admitting to moving back in with his parents.

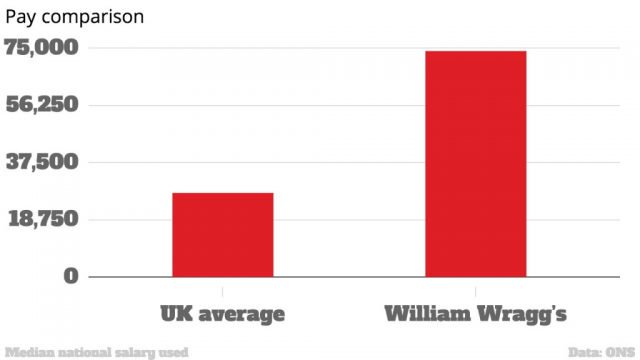

William Wragg, 28, earns £74,000 per year plus expenses as the MP for Hazel Grove. He is also entitled to House of Commons expenses to cover the cost of renting a second home in London, as well as office space.

Although he is, admittedly, “paid extremely well”, Wragg has been forced to move back in with his parents in the North West in order to save for a deposit.

Wragg earns over two and a half times the average national salary.

He explains his situation: “I am part of that boomerang generation. In a few years, hopefully I will have saved up enough for a deposit. I know exactly what it is like. I have complete empathy with people in that position.”1

Many aspiring homebuyers are taking proactive steps to finally getting on the property ladder. Recently, we reported that since its launch on 1st December 2015, a Help to Buy ISA has been opened every 30 seconds by those needing some extra help in saving for the huge deposits required.

Additionally, we announced yesterday that a whopping 15,000 Londoners are looking to use the Help to Buy London scheme to help with purchasing a property. This level is unsurprising, with London’s average house price now £506,724.

The housing spokesperson for Labour, John Healey, comments on Wragg’s circumstances: “He is part of a generation for whom homeownership is in freefall. This is a generation of people who are often on good middle incomes but who still find the dream of homeownership is out of reach.

“A million more people became homeowners under Labour, but since 2010, the numbers have fallen by 200,000.”1

It appears that more buyers are managing to get a foot on the ladder, however, as Marsh & Parsons reports a surge in first time buyer sales, up from 49% of all sales in December to 66% in January.

1 http://i100.independent.co.uk/article/even-74kyear-tory-mps-are-having-to-move-back-in-with-parents-to-save-up-for-a-house–WyM3qpeR6x?utm_source=indy&utm_medium=top5&utm_campaign=i100