Long-term house price growth and attachment to homes means that almost half of over-45s consider property as key to their retirement income plans, according to the latest Aviva Real Retirement Report.

The study found that 46% of over-45 homeowners – 6.08m UK households – see the wealth built up in their property as a key part of their retirement income plans, rising to 58% among the youngest age group (45-54). A generational shift in attitudes also means that this group are almost as likely to consider property wealth as part of their retirement income plans as their inheritance plans (60%).

However, with many over-45 homeowners pressured by existing mortgage debt, a desire to help their children get onto the property ladder, and concerns over making their money last in later life, the report asks: Are there enough homes to go around?

Mortgage freedom

Aviva found that almost one in four (23%) mortgaged over-45s are worried about paying off their property loans, including 8% who are very worried. This suggests that as many as 1.02m over-45s in the UK are worried about becoming mortgage free, with those who are very worried totalling 354,201.

With an average balance of £85,634, these homeowners carry an outstanding mortgage debt of £87.2 billion – equivalent to 7% of the UK’s £1.29 trillion mortgage debt.

One in three (33%) mortgaged over-45s do not expect to pay off their loans before passing the old Default Retirement Age of 65, while a further 17% do not know when they will become mortgage free. Worryingly, another 4% think that they will never pay off their mortgage – equivalent to 177,101 UK households.

Emotional attachment to property

Despite this mortgage pressure, Aviva’s report shows that almost seven in ten (69%) over-45 homeowners say their home is worth more than their pensions, savings and investments combined. With an average house price of £264,402 for this group – 27% more than the UK average of £209,000 – even those who still have mortgage debt are likely to have significant equity built up in their property.

Beyond financial concerns, many over-45s have also developed a strong attachment to their home. The average over-45 homeowner has owned just three properties in their life and has lived in their current home for 21 years.

When asked about their plans for retirement, four in five (80%) want to remain living in their current home for as long as they are physically able to. Comparatively, just 26% have either downsized already or plan to do so in the future. It is believed that if the older generations downsize their homes, the housing crisis could be solved.

Almost Half of Over-45s See Property as Key to Their Retirement Income Plans

The most common reasons for wanting to stay put are because homeowners are happy or content (31%), value their independence (26%), or feel they live in a convenient and safe neighbourhood (12%). Interestingly, the most common motive for downsizing is to find a home that is easier to maintain (41%), rather than financial reasons.

Borrowing in retirement

The Real Retirement Report suggests that a significant number of over-45 homeowners will need to borrow in retirement if they wish to stay in their current home. One in six (16%) expect they will need to keep borrowing or borrow again in retirement – equivalent to 2.12m households. More than half of these – 1.19m – will rely on their ability to borrow to remain in their homes.

More than 1m expect to need to borrow in retirement to meet daily living costs, while 1.72m believe they will need access to retirement lending to meet one-off expenses.

Demands on property wealth

More than half (52%) of over-45 homeowners feel they could benefit from using their property as an extra source of retirement income. However, significantly more of those in the 45-54 category (69%) feel this way than over-75s (39%).

Meanwhile, over-45s have other uses in mind for their property wealth. More than half (56%) believe it could pay for care in later life, while the same number feel their quality of life would benefit from using it to pay for home adaptations.

Additionally, 61% see property wealth as a key part of their inheritance planning. However, with younger generations facing a challenge to get onto the property ladder themselves, another shift may be occurring: 54% of over-45 homeowners would prefer to give money while they are still alive – a living inheritance – to help a family member buy their first home, rather than leave a traditional inheritance. Just 34% say the opposite.

Helping first time buyers

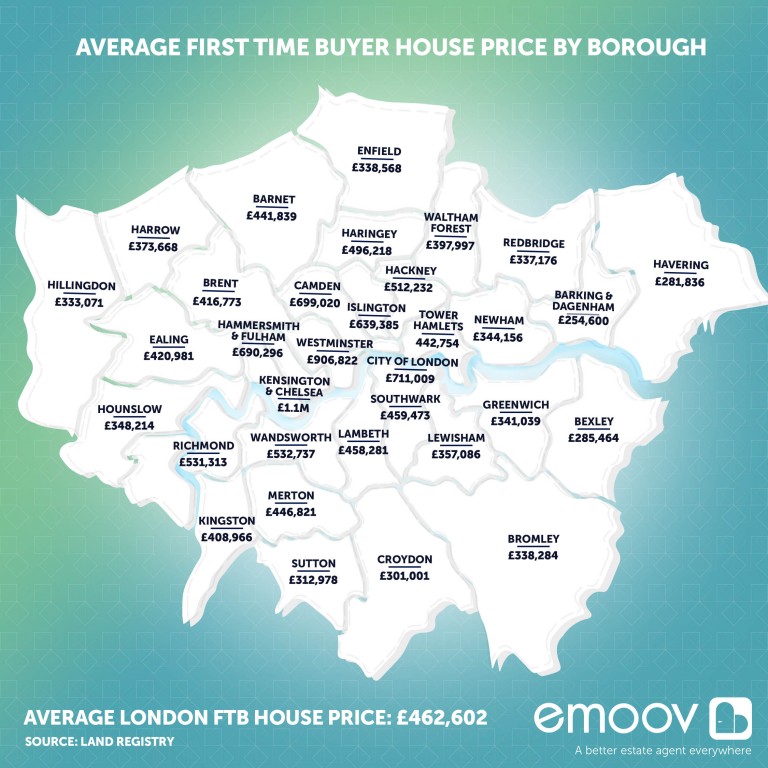

Almost one in three (31%) over-45 homeowners have already or plan to give money to help their child buy their first home, making an average contribution of £25,090. Most of those who provide financial support use their savings and investment income to do so, either to pay for a deposit (71%) or buy a property outright (10%).

However, an over-45s’ ability to help is often constrained by their own finances. Despite 43% believing that younger relatives will never own their own homes without family support, almost two in five (37%) would like to help their children get onto the property ladder, but can’t afford to.

Over half (52%) do not feel comfortable giving financial support without knowing how much money they will need themselves in later life. The report concludes that making their money last long enough is people’s greatest concern in retirement.

The trend towards helping younger family members may mean in turn that more over-45s need to use their own property wealth in retirement, either as an alternative way to provide a living inheritance, or to boost their retirement income as their savings are depleted.

The Managing Director of Retirement Solutions at Aviva UK Life, Clive Bolton, comments on the findings: “Pension freedoms have resulted in new decisions for people to make about how they use their life savings, and these findings suggest we are also starting to see a shift in attitudes towards wider use of property to help fund retirement, as well as providing a place to live. Property assets more than match pension wealth for many older homeowners, so it is sensible to consider bricks and mortar among the options to supplement their savings.

“However, later life brings a host of financial challenges and pressure points, which suggest it would be wise not to place all retirement bets on the house. The equity build up in people’s homes sounds like a lot, but considering that many can be retired for 20 years or more and often want to help their families as well as themselves, it’s easy to overestimate how far that money will take them. People need to consider if there are enough houses to go around and build this into their retirement plans alongside their other assets.”

He continues: “As well as boosting day-to-day funds, people also earmark their property wealth to help pay for care, leave an inheritance and help younger generations onto the housing ladder. There are also widespread worries about paying off mortgages to address in later life, along with a general desire to avoid needing to move from the place they call home.”