London Tenants Campaign Against No DSS Discrimination

This Saturday, London tenants are set to campaign against landlords and letting agents discriminating against renters on housing benefit.

The Yes DSS campaign, led by private tenant group Digs, demands that landlords and agents end the No DSS policies that prevent renters from accessing private rental housing.

These policies, which are becoming increasingly common across London, indicate that the landlord will not accept tenants in receipt of housing benefit.

Digs contacted 50 letting agents in Hackney, finding that just one property – a one-bedroom studio flat in the north of the borough – was available to tenants who claim housing benefit.

The amount of working individuals claiming benefits to cover their rent has doubled in the past five years, according to data from the House of Commons.

When the coalition government introduced housing benefit caps, it justified the move by insisting that it would encourage landlords to bring down high rents. However, Digs has found that rent prices in the capital have spiralled way above inflation and median earnings.

London Tenants Campaign Against No DSS Discrimination

On Saturday, tenants and campaigners will target a series of letting agents in Hackney who refuse to let to people on housing benefit. The demonstration will begin outside Hackney Town Hall.

They will publicly announce the agents that impose a standard No DSS policy.

The Yes DSS campaign calls for:

- An end to No DSS discrimination against tenants on housing benefit.

- A pledge from letting agents to only market rental properties that would accept tenants on housing benefit.

Heather Kennedy, of Digs, explains the cause for the campaign: “Where in the landlord rule book does it say that carers, disabled people, single parents or people on low incomes make bad tenants? These are just some of the groups of people discriminated against when agents, landlords and mortgage lenders say No DSS.

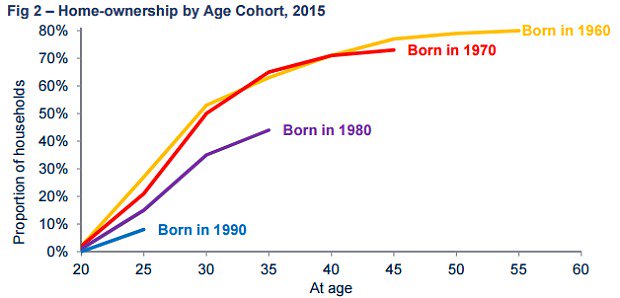

“Where are all these people expected to live? With homeownership far beyond the reach of normal people and no access to social housing, the private rented sector is the only housing option more and more of us have open to us. And yet people are being denied their last chance of finding a home, because landlords and agents, with increasing power to discriminate, unfairly tarnish everyone claiming benefits as undesirable.”

She insists: “We will no longer tolerate this kind of naked discrimination in our community from agents and landlords making huge amounts of money from people just desperate to find somewhere to live.”1

Eva, a mum of one and member of Digs, explains what the campaign means to her: “My son was 16-months-old when we moved into our rented flat. When we got our eviction notice, he was almost six. I was dreading the day the eviction notice came through the door.

“Even though I have been a model tenant, I have paid my rent without fail every month, I have maintained the property, I knew how rents in the area had shot up and I knew my landlord would be looking to make more money from the property than I could afford to pay.

“I started looking for another flat in walking distance of my son’s school. I work full-time and was able to find a couple of flats in my price range. But when I told the letting agent I claim a small amount of housing benefit each month because my wages don’t cover my rent, each and every one of them turned me away, saying they don’t take people on DSS.”1

If you are a landlord that accepts tenants on housing benefit, be aware that the new welfare system, Universal Credit, is being rolled out across the country. We are keeping you up to date with the latest areas subject to the change, to ensure that you stay informed about changes to your tenants’ financial circumstances. The most recent rollout areas can be found here: /yet-more-tenants-move-onto-universal-credit/

For a useful guide to letting to tenants on housing benefit, visit: https://justlandlords.co.uk/news/a-guide-to-letting-to-dss-tenants/

If you do decide to let your rental property to a tenant in receipt of housing benefit, remember to communicate often and effectively with them about their finances and consider rent guarantee insurance, which protects your rental income.

1 https://www.landlordtoday.co.uk/breaking-news/2016/2/renters-demand-landlords-end-no-dss-discrimination