Will student tenants be landlords’ ‘ray of hope’ in 2021?

UK rental guarantor service Housing Hand has highlighted that falling property prices, tax changes, and lower numbers of international renters will be a major stumbling block for the UK rental sector in 2021.

Jeremy Robinson, Group Managing Director of Housing Hand, says: “The only thing certain about the UK rental market following Brexit is uncertainty. Landlords face uncertain income from tenants, while tenants continue to face uncertain income due to the pandemic. Meanwhile, the number of working European tenants is likely to drop due to Brexit and COVID. All against a likely backdrop of falling property prices.

“The requirements for European tenants to travel, work and rent in the UK will change as a result of Brexit. Renting is likely to become more difficult, as the right to rent requirements will almost certainly change at some point in the not-too-distant future. Brexit’s effect on rental property, compounded by COVID, tax and legislation changes, means it is difficult to foresee many positives for landlords in 2021.”

Housing Hand points out that data from estate agent JLL indicates house prices in 2021 are likely to drop by 1.5%. Rental values are also predicted to fall by 1.0%. The guarantor service believes that factors such as lost GDP growth, rising unemployment, falling housing affordability, and the end of the furlough scheme will play a part in this.

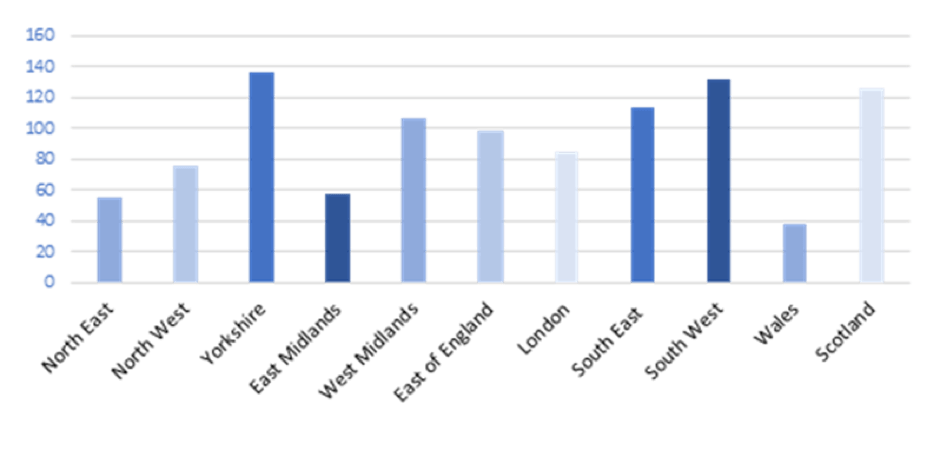

The problem might only be made worse by a reduction in international tenants, an increase in tenants defaulting on rent, and a possible oversupply of rental accommodation. However, Housing Hand’s ray of hope is student tenants.

Terry Mason, Group Operations Director for Housing Hand, comments: “The indications are that the 2021/22 academic year is likely to be a bumper year for students, with little reaction to Brexit.

“We have last year’s candidates who decided to take a year out rather than attending university now wanting to start. We also have a larger number of students reaching university age with fewer jobs available, meaning going to university becomes a safer option. Then there’s the fact that a larger number of international students started university in 2020 and will thus be returning for their second year.”