The average private renter in the UK pays over double the EU average for their home, revealed new maps published by the National Housing Federation (NHF).

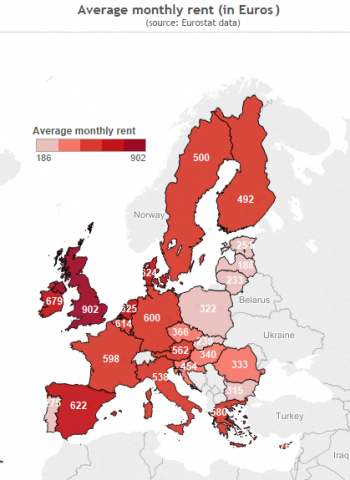

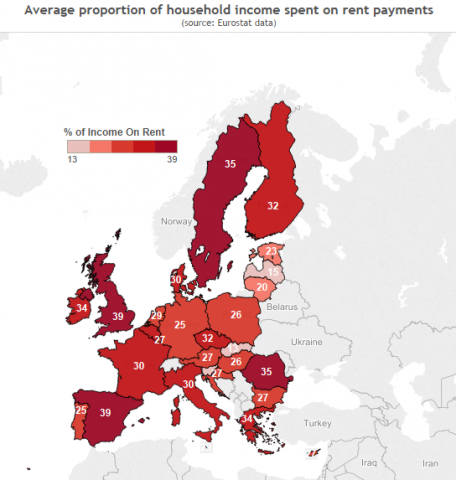

Based on EU figures for 2013 – the last year that figures are available for the whole continent – the maps reveal the cost of renting in different European countries. The first details the cost in absolute terms and the second as a proportion of the average wage.

Looking at countries as a whole can hide the huge differences between regions, but the results do provide a shocking insight into Europe’s private rental market.

The first map details the absolute cost of private rents. The UK average of €902 (£640) per month is the highest by a long way. In second place is Ireland, with a rental cost of €679 (£482). However, this is still significantly less than the cost the typical renter in the UK pays.

The next collection of high-rent countries include the Netherlands, Denmark, Spain and Belgium, all slightly over €600 (£426) per month. The lowest monthly rents are found in Latvia at only €186 (£132).

The wide gap between UK rents and rents elsewhere is striking. However, the second map gives a better picture of actual affordability. This one indicates how much of EU residents’ monthly income is spent on rent.

The UK is still the most expensive, but it now shares this position with Spain.

Renters in both countries spend an average 39% of their income on rent. Between the top and second position is a slight 4%. Sweden and Romania follow, where private renting households spend 35% of their wages on rent.

Latvia is still fairly cheap, with renters spending just 15% of their earnings on their home. However, Slovakia is cheaper still, at 13%.

In Western Europe, Germany and Portugal have the best ratio of rental cost to income, with households in both countries spending a quarter of their wages on rent.

The UK result is not shocking, considering the housing crisis across most of the country, especially in London. The capital is now subject to many international property investors, with residents believing homes are being built for the benefit of investors alone.

But this problem is spreading to other UK regions. Housing demand is substantially outstripping supply, even in areas that have previously been bubble-free, such as Scotland.

In some regions, newly signed rental contracts are as cheap as £560 (€788). However, new laws mean that pension-holders may now gain access to their whole pension fund, and therefore property investment is set to grow.

This puts considerable strain on renters. NHF researcher, Gerald Koessl, says: “Individuals and families [in the UK] have to spend the equivalent of around 23 minutes out of every hour worked to pay for their rent, while it is around 17 minutes of every hour worked across the whole of Europe.”1

Spain’s high rent costs, however, are more surprising. The country is still struggling to recover from its post-2008 economic crisis. A general lack of available cash should have pushed prices down. In fact, yields for Spanish rental properties have doubled in the past five years.

This could be due to the fact that Spain was a nation of owner-occupiers before the crisis. When the Spanish housing bubble burst, residents found it harder to secure financing due to falling wages and a recession. For those able to buy, wariness stopped them doing so.

This is understandable, considering the huge problem that Spain is facing regarding evictions. This has become so serious that Amnesty International is now campaigning against it. More tenants are chasing available properties and renters are seeing rent costs increase, despite their wages remaining static or even dropping.

It is unsurprising that both Madrid and Barcelona have now elected mayors with a history of campaigning for affordable housing and against evictions. Spaniards should not feel alone, however, as the maps indicate that fellow Europeans are not that much better off.

1 http://www.citylab.com/housing/2015/06/where-europeans-spend-the-most-on-rent-mapped/396833/