Index of Private Housing Rental Prices for Great Britain: February 2018

The Index of Private Housing Rental Prices (IPHRP) is an experimental price index tracking the prices paid for renting property from private landlords in Great Britain.

The report shows that private rental prices paid by tenants in Great Britain rose by 1.1% from January to February 2018, the rate of growth here being unchanged in those 12 months.

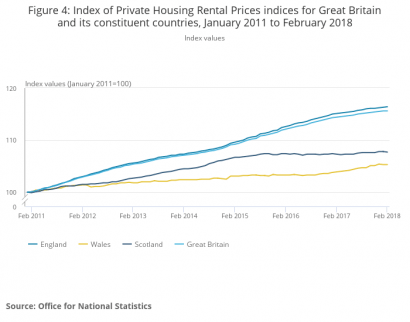

In England, private rental prices grew by 1.1%, Wales grew slightly more at 1.4%, and Scotland 0.4%.

In the capital, London has seen an increase of 0.1%, coming in at 1% below the average for Great Britain as a whole.

The IPHRP covers Great Britain as a series of price indices, and doesn’t measure newly advertised rental prices. Instead, it reflects overall price changes for privately rented properties. Whilst Northern Ireland is not currently included, the Office for National Statistics (ONS) is working to secure private rental data for the entire UK.

The 12 month growth rate of private rental prices paid by tenants in Great Britain has seen signs of a slow down since 2015. It has however increased by 1.1% in the last 12 months, leading up to February 2018. This has largely been driven by a slowdown in London over the same period; its growth rate (0.1%) is currently at its slowest since 2010, when in September it was at -0.4%.

From January 2011 to February 2018, private rental prices increased by 15.6%. However, London has a great impact on this, and if you exclude the capital, private rental prices increased by 12.6%.

What does this mean for the private rented sector? Kate Davies comments

The Executive Director of Intermediary Mortgage Lenders Association (IMLA), Kate Davies, commented on the ONS’ Index of private housing rental prices (IPHRP) in Great Britain in February:

“These figures reaffirm how subdued private housing rental statistics have been in the last few months. Whilst that may be giving tenants some temporary respite from higher rents, the flip-side is that landlords will be facing downward pressure on their cash-flows and profitability. This comes at a time when successive policy changes in the buy-to-let (BTL) sector have proved detrimental, with net BTL investment falling by 80% since 2015.

“We are already concerned that availability of private rental homes is unlikely to keep up with household numbers. We therefore ask the Government to recognise the benefits that a strong Private Rented Sector (PRS) brings for the UK, and the importance of maintaining a good supply of rental properties for the periods when home ownership is not suitable or achievable for households.”

It seems that all countries in Great Britain have experienced a rise in rental prices, however in England they have increased more than in Scotland and Wales. See below for the index values for Great Britain compared to its constituent countries.

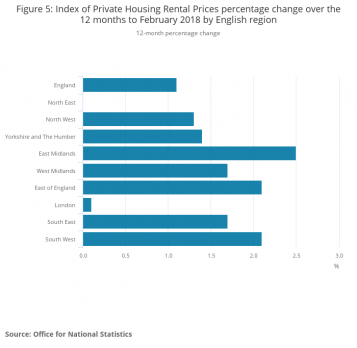

In London, it looks to be the case that growth in private rental prices is continuing to slow. The largest annual rental price increase was found to be in the East Midlands at 2.5% (down from 2.6% in January 2018). This is followed by the South West at 2.1% (unchanged) and the East of England at 2.1% (up from 1.9% in January 2018). The percentage change of private housing rental prices is shown below.