Only a Huge House Building Scheme Will Keep Housing Under Control, says NAEA and ARLA

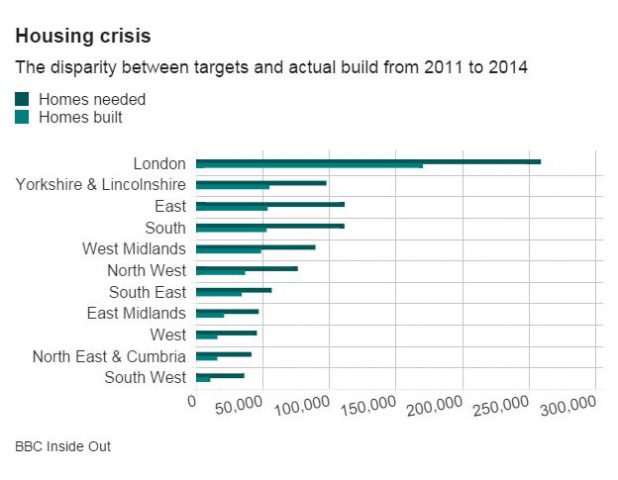

The National Association of Estate Agents (NAEA) and the Association of Residential Letting Agents (ARLA) have responded to ministers over the housing crisis. They believe that the only way to control the property market is through “a massive house building programme”.

The call is included in the organisations’ response to a Government consultation on housing.

Only a Huge House Building Scheme Will Keep Housing Under Control, says NAEA and ARLA

The document states that to increase the supply of reasonably priced homes, finance, land, time and skill are necessary.

“We need to stop thinking of housing policy in five-year election cycles and adopt a long-term approach to this critical issue,” it argues.

The response lists a number of measures that would help increase the amount of affordable homes.

It notes: “Bricks and other materials must be ordered a year before a home can be built and the UK needs skilled workers to ensure that properties are built to a high standard.”

It says that homes must be built on “suitable land that is located along existing transport corridors” and the “supply of reasonably priced housing coincides with infrastructure improvements”.

The groups also urge these homes to be built alongside “schools, hospitals, local shops and green spaces”, and believe better use of “unused public sector land” would benefit the market. This has been pledged in the latest Government starter homes scheme: /house-builders-respond-to-governments-latest-home-building-plans/

Once the homes are built, the NAEA and ARLA insist that “people need support in accessing finance to purchase property”, as house prices still exceed wages.

On private rental sector improvements, the document states: “ARLA believes that full mandatory Government regulation of sales and letting agents is the quickest and most effective method to eliminate unprofessional, unqualified and unethical agents from the rental market.”

“We think increasing supply of rental properties and raising standards across the industry must go hand-in-hand,” it adds.

The response – to the House of Lords Select Committee on Economic Affairs Inquiries into the Economics of the UK Housing Market – also warns against rent controls, claiming that if limitations on rent increases were introduced, landlords would start new tenancies with higher rents to prevent losses.

It says: “Higher rents would be essential to ensure mortgage payments and maintenance costs could be met.”1