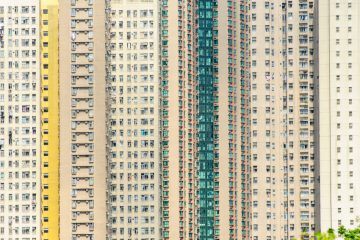

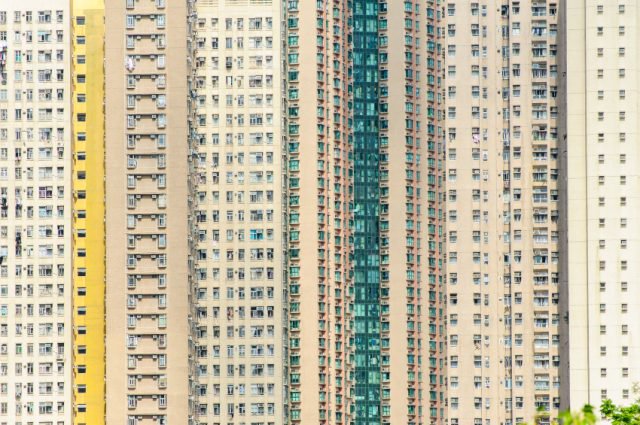

2016 looks to be a key year for the property market. Certainly, there is much more to consider than whether property prices will go up or down!

It looks increasingly likely that the Bank of England will follow the decision of the US Federal Reserve and raise interest rates in the coming months.

So just who and what will be most affected in the market over the coming year?

Landlords

Unfortunately, it seems as though buy-to-let landlords will see a particularly difficult 2016.

Stamp Duty

One alteration certain to have an impact on the market is the stamp duty hike coming into force on April 1st. Buy-to-let landlords and property purchasers buying a home that is not their main residence will face an extra cost of 3% in tax.

It is suggested that these changes will deter some potential buyers. With sales and mortgages being revived over recent years, the property market is set to receive some setbacks in 2016.

Tax Breaks

On top of stamp duty rises, a reduction in tax break privileges has been slated for, after an announcement in the Chancellor’s summer budget

What’s more, the Bank of England has indicated that it wants power to limit lending to buy-to-let borrowers and it appears likely that the Chancellor will side with this view.

The Government seemingly puts the blame for lack of affordable housing at the feet of private landlordism, with a booming private rental sector seeing potential home-owners out in the cold.

Buy-to-let

Simon Rubinsohn, chief economist at the Royal Institution of Chartered Surveyors (RICS) noted that, ‘the Government is very motivated to reverse the trend in owner-occupation-this is now a very important part of the Government’s housing strategy.’[1]

‘Buy-to-let landlords have had a very good run-holding property has been a very lucrative investment, so if the Government has to squeeze the buy-to-let landlord it will take that in it’s stride,’ Rubinsohn added.[1]

Property commentator Henry Pryor called the moves, ‘an extraordinary about-turn for landlords.’ He went on to say, ‘because rents are unlikely to rise to compensate for the increase in stamp duty, capital values are likely to fall-which is the Government’s intention.’[1]

How will the property market change in 2016?

Right to Rent

Just next month on February 1st, the controversial Right to Rent scheme will be rolled out in full across the country. Landlords will be responsible for checking the immigration status of potential tenants and could be fined up to £3,000 for non-compliance.

Pryor suggests, ‘many landlords are finding this is a rather frightening prospect and are talking of giving up as a result.’[1]

The Council of Mortgage Lenders forecasts that the number of new loans made to landlords will dip substantially, from 116,000 in 2015 to 90,000 in 2017.

Mortgages

It is now nearly seven years since the Bank of England cut interest rates to a record low of 0.5%. From then, economists have predicted that rates would begin to rise again, but have consistently been wrong.

However, it looks as though 2016 could well be the year where rates do eventually rise. The majority of independent economists believe that the first rises since July 2007 will occur in this year and will come in two increments of 0.25% each.

Ed Stansfield, forecaster at Capital Economics, thinks, ‘the economy is probably a little bit healthier than the collective wisdom of the Bank’s Monetary Policy Committee thinks. We think that one of the things that will convince the Bank to act is continued signs that incomes are recovering.’[1]

Thankfully, a growth in incomes should soften the blow of any interest rate hike.

Troubled Times

For many years, the low base rate has led to very low mortgage rates, making large mortgage rates seem affordable.

Schemes such as Help-To-Buy have buoyed house prices and sales, meaning many thousands of potential homeowners have received money to buy a property when previously they would not have been able to do so.

A steady growth noted in the economy, coupled with rising employment and income, means that prices and sales should remain at least even.

However, Ray Boulger, of mortgage brokers John Charcol, suggests that there could be some turbulence in the early months of this year. He believes that many people will rush to purchase buy-to-let property before the higher rates of stamp duty take effect.

‘Those people who want buy-to-let properties are clearly going to be incentivised to complete before 31 March. Till then I think we will see some quite strong growth in prices, then I expect to see prices falling for the next few months as that element of demand is taken out of the market,’ Boulger added.[1]

[1] http://www.bbc.co.uk/news/business-35135639