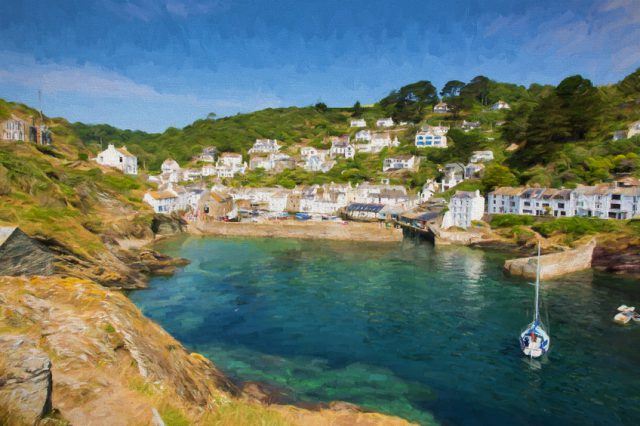

Staycation boom has led to increase in property investors seeking holiday let tax advice

Demand for holiday lets as the UK prepares prepare for a ‘staycation summer’ has led to an increase in requests for tax advice in regard to purchasing a second home.

Handelsbanken Wealth Management (HWM) advises would-be buyers to focus on rules that will allow them to qualify for tax breaks associated with furnished holiday lets (FHL) as distinct from traditional residential lettings.

HWM says that to qualify as an FHL, a property has to be let fully furnished and has to be in the UK or the European Economic Area, which includes the EU plus Iceland, Liechtenstein, and Norway. It has to be let on a commercial basis with a view to making a profit; letting to family and friends at reduced rates does not count.

It has to be available for letting for at least 210 days a year and let as an FHL for at least 105 days a year. It must not normally be let to the same person for a continuous period of more than 31 days. There are exceptions on the 105 days rule which COVID-19 will cover and owners with more than one property can average the threshold across their properties.

Mark Collins, Head of Tax at Handelsbanken Wealth Management, said: “Couple this trend for staycations with temporarily low Stamp Duty Land Tax rates, it should come as little surprise that we’ve noticed an uptick in the amount of tax advice requested by customers thinking about buying a second property in the UK.

“While our customers might be considering a second property for use as a holiday home or to let to the general public, we’ve found that more often than not their motivation is a combination of the two.

“From a tax perspective furnished holiday lets present an unusual hybrid: not quite a business in the conventional sense, but benefiting from a number of useful tax breaks associated with business enterprises unavailable to regular buy-to-let landlords.”

HWM points out that FHL owners can deduct the full amount of their finance costs such as mortgage interest from their turnover to calculate taxable rental profits (unlike with residential buy-to-let properties) and profits from an FHL can be apportioned between spouses for tax purposes in reference to the work done. FHL profits also count as relevant earnings for contributing to a personal pension which could help reduce the tax bill.

The sale of an FHL business could qualify for Business Assets Disposal Relief giving the owner the chance to pay Capital Gains Tax (CGT) at the 10% rate subject to the availability of their £1 million allowance.

FHL owners may also be able to gift their property to another person and claim to holdover any arising capital gain through the gift of business assets relief rules. The person getting the property would receive it with a CGT base cost reduced by the capital gain held over by the original owner.

FHL owners who sell their property and reinvest in another or other business asset could claim CGT rollover relief and defer the capital gain arising until the replacement FHL is sold.

Owners who decide to let out homes under an Airbnb arrangement can also qualify for tax breaks. The property allowance exempts from income tax up to £1,000 rental income a year. If gross annual property income is £1,000 or less, it is not taxable and there is no need to report to HMRC.

Mark Collins added: “Of course, we always recommend seeking professional tax advice to ensure that qualifying conditions are met by the owners and CGT reliefs are correctly claimed.”