Student Tenants Unimpressed with the Standard of Accommodation on Offer

Student tenants are unimpressed with the standard of accommodation being offered to them, according to a panel of judges at Property Week’s new Student Accommodation Awards.

The magazine has scrapped a category in its inaugural awards show for providers of student accommodation, after the judges – students – refused to offer the gong to any of the entrants.

The student tenants criticised institutional providers of student accommodation, such as private halls of residence, for charging too much, providing the wrong sort of accommodation, and putting their shareholders first.

They said they did not want to award a single one of the entrants.

The Student Accommodation Awards, organised by Property Week magazine and aimed at institutional providers rather than traditional student landlords, had a Student Experience category.

This category has now been scrapped, just weeks before the awards ceremony in central London, where other gongs will be handed out, despite the clear dissatisfaction from student tenants.

The event will also raise the question of build-to-rent investment in the private rental sector, which is being heavily backed by the Government.

The student judges wrote to the organiser of the event, which will be held early next month:

“Dear Property Week,

We appreciate the opportunity given to us, as students, to judge the Student Experience category for the upcoming Student Accommodation Awards.

However, we regret to inform you that the panel could not come to a decision to award any of the entrants.

Unfortunately, none of the entrants could demonstrate that they are meeting the urgent need of students to live in accommodation that will not force them into poverty.

Most entrants price their cheapest rooms above the national average of £146 per week, and certainly above a level which student maintenance loans will reasonably cover. Many charge rents of more than £300 per week.

Student Tenants Unimpressed with the Standard of Accommodation on Offer

One entrant is reported for having put disabled students at great risk of danger. Another charges hundreds of pounds to act as guarantor, profiting from the discrimination of migrants and the inability of poor estranged students to provide a guarantor.

Another, in their application, puts shareholder satisfaction before student satisfaction and boasts of ‘£20m revenues’.

Students are not seeking luxury getaways or cinemas in our living rooms. We are not satisfied knowing our student debt is lining the pockets of millionaire shareholders.

High rents are driving the social cleansing of education. Working class students are being priced out; unable to access higher education altogether, or forced to work long hours, disadvantaging the poorest.

We urge all providers to invest in affordable accommodation so that the future of higher education is open to all, regardless of parental income.

We urge all universities to cease the privatisation of accommodation, and to provide a guarantor service.

We urge the sector to lower profits, reduce rents and support the call for greater financial support for students in the form of universal living grants.

Unless all students have access to safe, affordable accommodation at every institution and the means to pay for it, there is no cause for celebration, nor the ability for us to award a for-profit sector failing so many of our peers.

Yours sincerely,

Student Accommodation Awards student judges 2016”

A spokesperson for the Student Accommodation Awards responds to the letter: “The Student Experience award is aimed at recognising student accommodation schemes that have tangibly enhanced student life.

“We completely respect the decision of the judging panel not to make an award in this category. Developers and operators of student accommodation strive to produce the very best environment for students, but our student judges have sent a clear message that the industry needs to do better.

“In light of this, we have taken the decision to remove this category for this, our inaugural event, and review it for 2017.

“This is the first year of the Student Accommodation Awards, so the limited number of categories does not fully reflect the range of student accommodation provided by the industry.

“Next year, we will expand the awards categories and include a category for the best affordable student accommodation.

“We will continue to encourage the industry to raise its game and put the student experience at the centre of everything it does.”

One traditional landlord, Dr. Rosalind Beck, believes the student tenants have made an important point.

She explains: “As a licensed landlord with student housing in Cardiff, my rents average around £265 a month excluding bills, and around £330 a month including bills in traditional houseshares, some of which have lovely original features and are often spacious and characterful.

“I am flabbergasted at how these institutions now think they can charge these huge rents for their allegedly luxurious provision. As the students say, they can’t afford this luxury. They would prefer cheap and cheerful, and to not be saddled with enormous debts.”

She continues: “This is a truly awful development (misrepresented as an improvement) and will have extreme repercussions for the young people of this country.

“The problem is that the institutions may gain a monopoly, as many portfolio landlords, who provide the far more affordable traditional lets, will be driven out of business because of having to pay huge amounts of tax on their main cost, while the institutions continue to deduct finance costs as an allowable expense (which is normal business practice).

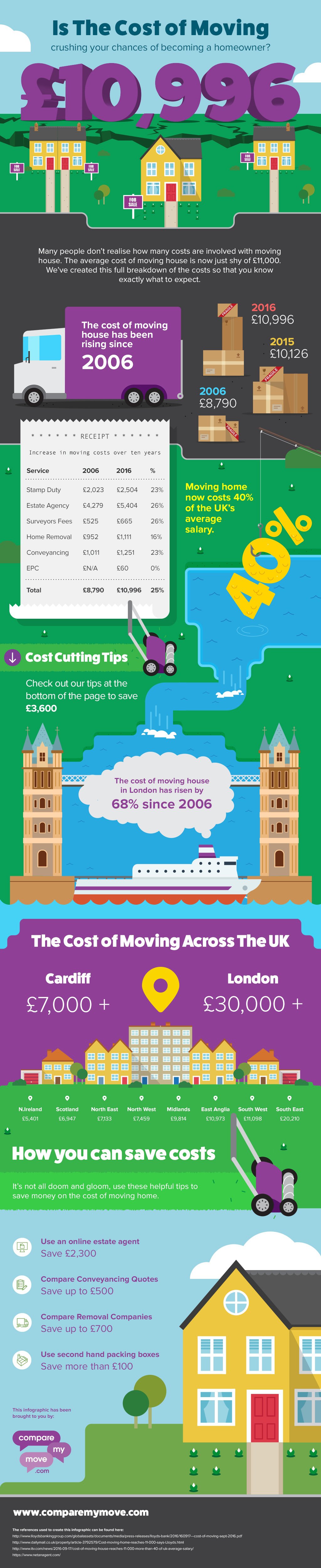

“To make matters worse, the students might not have taken into account the fact that there is also likely to be a knock-on effect, whereby the institutions also gain dominance in the young, professional let market, so they will have to shell out huge amounts of their salaries for years to come, thwarting any ambition to save a deposit to buy their own home and condemning them to all of the worry experienced by people facing a life in debt.”

She adds: “George Osborne stated that this fiscal attack on landlords would help first time buyers. We can all see how that was a lie.

“This Government-sponsored programme of handing institutions a monopoly in the market must be halted immediately.”

Do you rent to student tenants? If so, do you agree with their claims?