UK Property Market Bucks the Seasonal Trend

The UK property market has bucked the traditional seasonal trend usually seen at this time of year, according to Agency Express’ Property Activity Index for November.

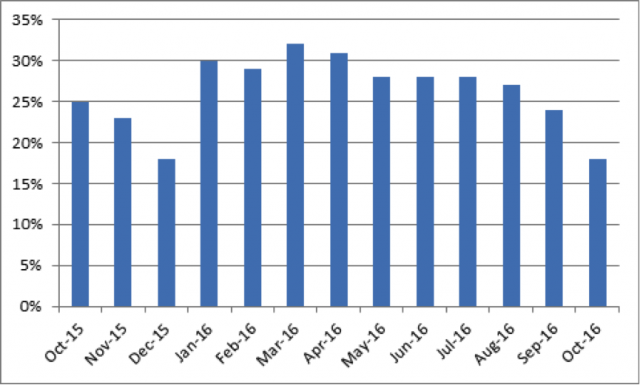

During November, it is typical to experience a slowdown in activity in the UK property market as we head for the Christmas period. However, last month’s figures show unseasonal strength – new property listings dropped by just 4.7%, compared to 12.2% in 2015, while the number of properties sold fell by 1.8%, compared with 14.7% last year.

UK Property Market Bucks the Seasonal Trend

Reviewing its historical data, Agency Express reports that the UK property market has not experienced this level of activity since 2013.

Across the UK, 11 of the 12 regions included in the index recorded robust figures for November.

Last month’s top performing region was East Anglia, where new listings rose by 0.4% and properties sold increased by 2.4% – a record best November for the region.

Other regions bucking the seasonal trend include:

Properties sold

- North East: +24.3%

- Scotland: +6.9%

New property listings

- Central England: +11.3%

- South East: +5.9%

- London: +0.6%

The only region to record a monthly decline in November was Wales. New property listings dropped by 14.8%, while the amount of properties sold was down by 3.2%. However, the decline in the number of properties sold was much lower than that recorded in 2015, when it fell by 11.8%.

Stephen Watson, the Managing Director of Agency Express, comments: “A surprisingly buoyant month for November; month-on-month figures have reported positively across the nation, and year-on-year activity has also increased. It will be interesting to see if the change in trend will have a positive effect on the forthcoming weeks, where we traditionally witness a slowdown until January.”

Have you decided to buck the seasonal trend by buying or selling a property at this usually quiet time of the year?