Is the Right to Rent Scheme Racist?

A campaign group has been set up opposing the Right to Rent scheme on the grounds that it is racist.

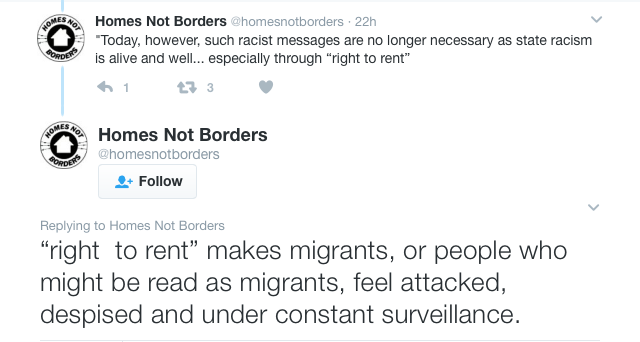

The group, called Homes Not Borders, has launched a campaigning website after initially setting up a Twitter account last October. It is now threatening direct action against the “racist” legislation.

Under the Right to Rent scheme, landlords or their letting agents are legally obliged to check the immigration status of all prospective tenants. Those that knowingly let to illegal migrants could face criminal penalties.

Our guide, created in association with the Home Office, comprehensively details how landlords and agents can comply with the scheme: /home-office-reinforces-landlord-responsibilities-right-rent/

Homes Not Borders claims to be made up of people who have been directly affected by the Right to Rent scheme, insisting that the legislation is intensifying discrimination of migrants.

Is the Right to Rent Scheme Racist?

It highlights research from the Joint Council for the Welfare of Immigrants into the pilot scheme in 2015, which found that 65% of landlords would be less likely to let to someone who required a little time to provide documentation, while 42% would be less likely to consider letting to someone who does not have a British passport.

More worryingly, 27% would be less likely to open discussions with a prospective tenant who “had a name which doesn’t sound British” or “had a foreign accent”.

Before the scheme rolled out nationally on 1st February last year, concerns were raised over how the scheme could be considered racist.

A statement on the Homes Not Borders website reads: “The Right to Rent will only intensify the discrimination that migrants and people of colour face in their search for housing, exacerbating the housing crisis for particularly vulnerable communities.

“Homes Not Borders are building a movement to abolish the racist Right to Rent. As people directly affected by this policy, we are organising our communities through building relationships, developing bonds of solidarity work across the diverse, migrant, non-migrant communities of colour. We will use all tools at our disposal, including direct action.”

It adds: “This racist Right to Rent must be challenged. It must be resisted. It must be abolished.”

Do you believe the Right to Rent scheme to be racist, or induce racism in the private rental sector?