Whether you’re a first time tenant or an experienced renter, renting a property can present challenges for anyone if you’re unprepared. We have the top ten tips all tenants need to know…

From losing your deposit to falling foul of rogue landlords, it’s important that all tenants take the advice and help available to them to make the lettings experience as simple as possible.

ARLA Propertymark (the Association of Residential Letting Agents) shares its top ten tips to help avoid the common pitfalls of renting.

Sally Lawson, the President of ARLA Propertymark, says: “With more and more people completely priced out of the property market and a desperate shortage of housing, private rentals have become the norm. However, there is a lot to consider when choosing a property to rent and there can be a lot of unanswered questions, which can be overwhelming.

“The below checklist has been created to make sure your next letting experience is a positive one, including all there is to know on the process to make it as simple and stress-free as possible.”

Before you start looking:

Know what’s important to you

The Top 10 Tips all Tenants Need to Know

Before you start looking for a new rental home, work out what’s important to you, such as the number of bedrooms or parking spaces the property has, as well as local amenities and proximity to friends, family, schools and work.

What can you afford?

Decide what you can afford before you start house hunting. Remember that you will also have to budget on top of your rent for household bills, including gas, electricity and water, internet, TV licence, contents insurance and Council Tax, as well as food and general household items.

Choose your housemates carefully

Disagreements between housemates are very common in the rental sector. Conflicting lifestyles and personality clashes can cause misery and stress; remember that a fun friend is not necessarily a good housemate, so choose wisely.

When you’re looking:

Using a letting agent

If you are using a letting agent, make sure that it is a member of an authorised redress scheme, as this should mean that it has Client Money Protection (CMP). This ensures that, if the agent goes bust or runs off with your money, the scheme will reimburse you and make sure that you’re not left out of pocket. You will not get this protection if you rent directly from a landlord or through an unregulated letting agent.

Ensure you’re protected

You are entering a legally binding agreement when you sign a contract with your landlord, so don’t feel pressured to sign immediately. Make sure that you take your time to read the contract thoroughly. Ask as many questions as you want to, until you’re comfortable that you understand everything it contains. If you’re not happy, ask for any changes or amendments that you want.

Know your rights

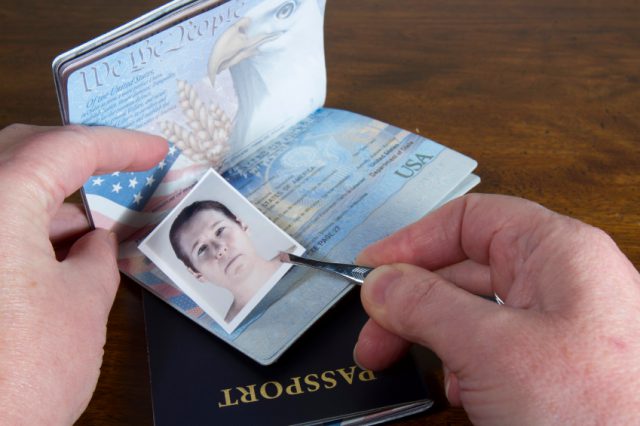

Before you sign the tenancy agreement, you will be asked to provide proof that you have the right to rent in the UK, so make sure that you have your identification documents (such as your passport) to hand. After you sign the contract, you must be given a copy of your new home’s gas safety certificate (if the property has gas), its Energy Performance Certificate (EPC), the Government’s How to Rent guide, your deposit protection certificate and the prescribed information, and any licence for your property from the local council (if a licensing scheme exists in the area).

Once you’re in the property:

Make sure your new home is safe

Smoke alarms are required on all floors of your home and carbon monoxide detectors are needed in any room where solid fuels are burnt. These need to be tested and working on the first day of the tenancy; this is usually done at check-in. The landlord or letting agent will also probably undertake an inventory and schedule of condition at this point. Make sure that you go through these documents, and notify your landlord or agent if you disagree with what they contain, as this will affect how much of your deposit you get back at the end of the tenancy.

Sort out the bills and insurance

If this hasn’t been done by your letting agent, notify the utilities companies and give them meter readings, your move-in date and the names of all new tenants. Make sure that you have contents insurance – your landlord will insure the buildings and their own contents, but you need to cover your own belongings against loss or damage.

Address issues before they become bigger problems

Don’t be afraid to report repairs to your landlord or agent. It’s much easier, faster and cheaper for your landlord to fix an issue when you first notice it than when it becomes a bigger problem. If you leave the home empty for a prolonged period, consider leaving the heating on low to ensure that pipes don’t freeze during the winter. Also, if you’re going away for more than a couple of weeks, let your landlord or agent know so that they can keep an eye on the property.

Return the property as you found it

Most deposit disputes are over the condition of the property at the end of the tenancy. Make sure that you give the place a thorough clean before you move out and leave it in the same condition as the day you arrived.

We hope that these top tips help you on your way to having a successful lettings experience!