Top UK buy-to-let hotspot for 2021 predictions from Fabrik Invest

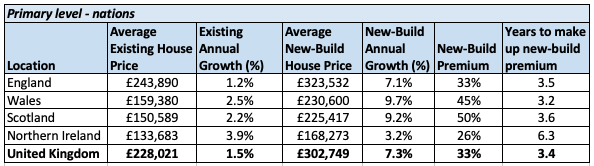

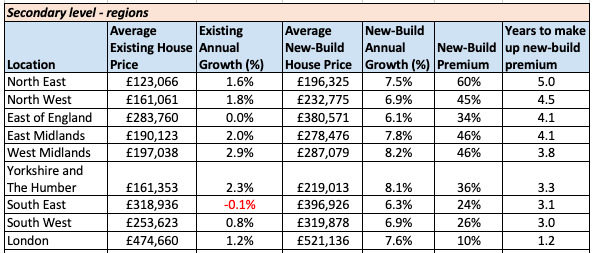

With the English Housing Survey 2019 to 2020 confirming that the private rental sector (PRS) continues to house 19% of England’s households, property investment company Fabrik Invest predicts a strong year for buy-to-let.

As such, the company has put together its list of top UK buy-to-let hotspots for 2021:

Manchester

Fabrik Invest states that Manchester tops the table as a result of its rapidly rising property prices and rents and strong long-term prospects.

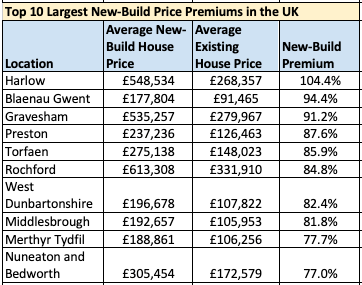

Preston

Regeneration schemes are also at the heart of the city of Preston’s appeal, the company analyses.

York

They predict that the Yorkshire and the Humber region will outperform the UK average for house price rises over the coming five years, while the city’s tourism sector will also come into play.

Birmingham

Fabrik Invest comments that Birmingham is another destination that warrants keen attention, thanks to its shortfall of over 30,000 homes by 2031. In particular, the city’s most fashionable location – the Jewellery Quarter – will deliver some exciting investment opportunities this year.

Chatham

Their final UK buy-to-let hotspot prediction is Chatham, due to a combination of substantial local regeneration, swift train journeys into central London, and a rapidly growing population.

The company also believes that the upcoming Stamp Duty holiday deadline will increase competition in the buy-to-let market. Dale Anderson, Managing Director of Fabrik Invest, comments: “The Stamp Duty deadline, Brexit and COVID are going to create some interesting conditions for the UK’s property investment market in 2021.

“Underpinning all of these is the country’s continued shortfall of housing supply, which creates an inviting marketplace for investors looking to pick up rental properties this year.”

Currency fluctuations as a result of Brexit might also result in some significant overseas interest in UK property investment. Anderson comments: “If the pound falls as a result of the UK parting ways with the EU, we’re likely to see a surge in investment from overseas buyers looking to take advantage of suddenly being able to get more for their money.

“The UK remains a preferred investment destination for buyers from a wide range of other countries, many of whom will be keeping a close watch on exchange rates throughout 2021.”