The Chancellor Missed an Opportunity in the Autumn Statement, Insists the SLC

The Society of Licensed Conveyancers (SLC) has offered a mixed reaction to the measures announced in last week’s Autumn Statement, which was delivered by Chancellor Philip Hammond.

The Chancellor Missed an Opportunity in the Autumn Statement, Insists the SLC

Firstly, the SLC welcomed the news that the Land Registry will remain in public ownership, which the society has lobbied for over several years. It claims that this will take away any uncertainty for the CEO of the Land Registry, Graham Farrant, and his team, so that they can concentrate on increasing the coverage of the register and eliminating the backlogs in first registrations and more complex transactions.

However, the SLC was disappointed that the Chancellor did not take the opportunity to reverse the “very damaging reforms” brought in by his predecessor, George Osborne, on private landlords.

The increased Stamp Duty obligation and reduction in mortgage interest tax relief will not only increase rents for tenants, particularly at the lower end of the market, warns the SLC, but will also contribute to a slowdown in the housing market in terms of transaction levels.

The Chairman of the SLC, Simon Law, responds to the Autumn Statement: “We are delighted that the Land Registry is going to remain in public ownership and we look forward to working with their executive in a number of areas that should improve the overall home buying and selling experience for consumers.

“We are less than happy, however, that the Chancellor has not heeded calls to reverse the very damaging attack made by George Osborne on private sector landlords. The level of housing market transactions will be adversely impacted in a way that is damaging to the economy, and will ultimately put up rents for hard-pressed tenants.”

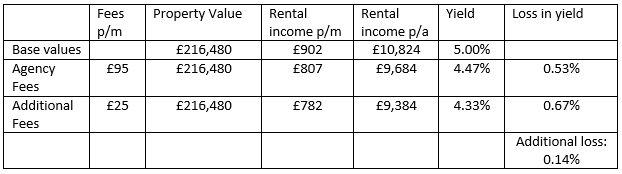

In addition, the SLC is not convinced of the benefits of the Chancellor’s plan to ban letting agent fees for tenants.

“At the end of the day, these charges will end up being paid by tenants in rent and will thus be less transparent than when applied directly,” Law believes. “It will be more difficult to identify the behaviour of rogue agents.”

Do you believe that the letting agent fee ban will have a detrimental effect on the private rental sector?