The Average Property Price in Each London Borough Following Brexit

The Average Property Price in Each London Borough Following Brexit

Although the Brexit result caused uncertainty in the housing market and we are still awaiting its full impact, property prices in London are expected to remain robust.

For those with properties in London, these volatile market conditions may have caused concern over the value of your assets. But fear not, recent house price data from Rightmove suggests that the London property market is staying strong.

Over the past few years, London has seen constant double-digit growth in house prices, leading to many people being priced out of the market.

In the year to May, Land Registry figures show that this trend continued for two-thirds of London’s boroughs.

However, during this period, the more affluent boroughs of the capital recorded either very modest growth or declines in house prices. Islington and Hammersmith & Fulham recorded rises of 4.7% and 2.7% respectively, while prices were own by 9.2% and 2.5% in the City of London and Kensington and Chelsea.

Ahead of June’s Brexit vote, this slowdown in the prime central London market was widely attributed to an oversupply of luxury homes and the higher 12% Stamp Duty rate for properties priced over £1.5m. With these factors continuing to have an effect on the market, it is no surprise that the prime market remains slow. However, the latest figures from Rightmove show that this trend is rippling out to higher-priced properties over London.

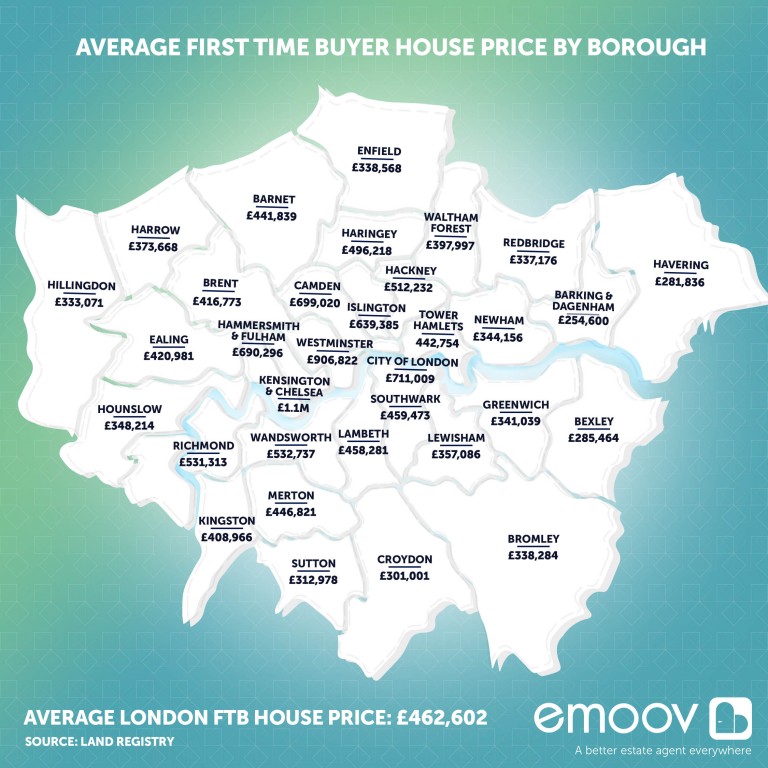

The following data highlights the average house price in each London borough post-Brexit.

The average property price in each London borough

[table id=21 /]

Following the cooling in the market ahead of the Brexit and further uncertainty about the impact of the vote in the past month, it is easy for property owners to expect the worst.

However, Nina Skero, of the Centre for Economics and Business Research (Cebr), has some good news: “Although Brexit has certainly sent shockwaves, Cebr expects the housing market to slow down but not plummet.”

The consultancy expects house prices to continue growing this year and from 2018 onwards, but has forecast a 5.6% decrease next year.

Simon Rubinsohn, the Chief Economist at the Royal Institution of Chartered Surveyors (RICS) has predicted a similar dip, but has positive long-term expectations: “Prices are expected to rise, albeit a little less than previously anticipated, with a cumulative increase of 14% projected for the next five years.”

Even if the former Chancellor, George Osborne’s predictions of an 18% decrease is realised, this would only mean a return to last year’s house price levels for much of London, which is not a catastrophe.

Additionally, the sky-high house prices in the capital are continuing to keep many prospective homebuyers out of the property market, which is good news for landlords.

However, those hoping for property prices in the capital to plummet could be disappointed – as long as demand outweighs supply, the London housing market will remain as resilient as ever.