Real estate blog Point2 Homes asked 29,000 people from nine countries about their current and ideal home sizes, to get a global perspective on typical residences and home size expectations. According to the survey, Brits have the fourth largest homes on average among surveyed countries, but ideal home size expectations are even bigger.

The nine countries surveyed were the UK, the USA, Canada, Australia, France, Germany, Spain, Mexico and Brazil. Here are some key findings:

- 38% of British residents surveyed said their ideal home should exceed 2,501 square feet of space

- Almost two thirds of UK respondents said their ideal home should be larger than the one they already live in

- UK respondents have the same ideal home size expectations as respondents from Mexico and Australia

- The UK and France are tied when it comes to the average current home size– between 1,500 and 1,600 square feet

The expectations of British respondents may come as a surprise, considering that Americans, Canadians, and particularly Australians are the ones better known for their love for large homes. However, considering that the average Canadian home is over 200 square feet larger than the British equivalent, American homes are 400 sq. ft. larger, and Australian homes 500 sq. ft. larger, the Brits’ desire for more room makes sense.

UK Ideal Home Size among Largest in the World, Survey Reveals

Britain in 4th place for average home size

The answers tallied during the survey show great diversity, both in terms of home sizes and expectations. Australia, for example, has the largest homes by far, but also wants the largest homes. Brazil, on the other hand, has the smallest average home size among surveyed countries, while expectations here are mostly reasonable.

At 1,590 square feet, British homes are larger than those in other European countries, like France, Germany, or Spain. In fact, the UK comes closest to entering the top three countries with the largest homes among the nine surveyed, behind Canada by only 10%. The US and Australia are in a league of their own, with average home sizes hovering around 2,000 sq. ft.

Britain in 1st place for largest ideal homes

However, the ideal home size is a different story, as residents of some countries simply like to dream big. Here, the UK is in the lead, with the biggest gap between average actual home size and ideal residence. 38% of Brits surveyed think the ideal home should be over 2,501 sq. ft. in size.

23% of responders in the UK say their ideal home would be larger than 3,000 square feet. Only Australians come close, with 21% of respondents stating that their ideal home would be at least 3,000 sq. ft.

The Australian’s homes surveyed are 2,032 sq. ft. on average, but most respondents think homes of over 2,501 sq. ft. would be ideal. Oddly enough, residential developers down under are building smaller homes, while recent reports in Britain show that the average size of a newly built home has been increasing since the 1990s.

Mexico isn’t far behind in terms of lofty home size expectations, as 32% of respondents stated that their ideal home size should exceed 2,501 square feet.

Brits enjoy little individual personal space, driving preference for larger homes

Brits enjoy little individual personal space, driving preference for larger homes

While average home size is an important metric, according to a report by the Royal Institute of British Architects (RIBA), property listings in the UK focus much more on the number of rooms in a house. Why? Because individual personal space is perhaps more relevant to homebuyers than total house size.

“Unlike in many other countries, homes are marketed by the number of bedrooms rather than floor space. This idiosyncrasy of the UK housing market means that space is not easily understood or translated into any meaningful information for consumers,” states Rebecca Roberts-Hughes, author of the RIBA report.

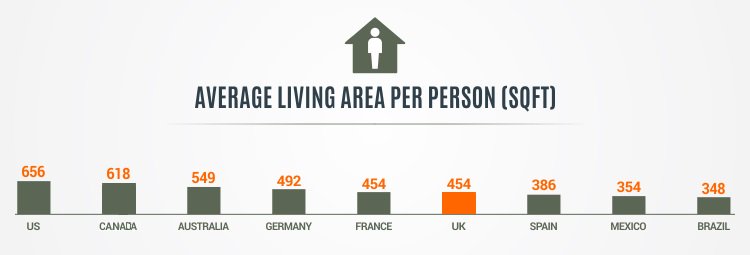

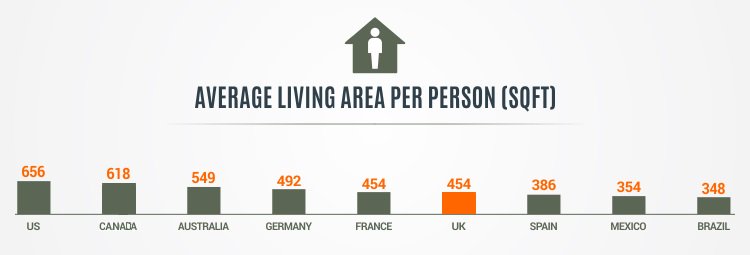

Divide the average UK home size by the average number of family members among respondents, and the result is 454 square feet per person. This figure places Britain among the countries with least individual living space.

Brits still have more breathing room in their own homes than Spaniards, Mexicans or Brazilians. Germans, on the other hand, may have smaller homes, but the survey data shows that they also have smaller families on average, which gets them more space per person than the French or the British.

The survey results also highlight the differences between what is typical in European countries, and what is typical in countries from the Americas and Australia. Generally, the latter tend to build larger homes. Among the European countries surveyed, Britain still reigns supreme in terms of home size. Ultimately, the survey shows that Brits are the biggest dreamers of all.

Methodology

The Point2 Homes survey was made in Google Surveys and distributed to users via the Point2 Homes real estate platform and many other real estate websites in all surveyed countries, in the form of an optional pop-up. Point2 Homes analysts tallied and correlated the answers in-house.