Rental stock dwindles, despite more tenants than ever seeking housing

ARLA Propertymark’s latest report reveals that demand for rental accommodation reached a record high in January. An average of 88 prospective tenants registered per member branch.

The January Private Rented Sector (PRS) report, released yesterday, also shows that despite this record high, the supply of rental stock has also fallen to the lowest level in seven months.

Demand from tenants

- Agents have witnessed a 57% increase in the number of prospective tenants registered since December.

- Year-on-year, demand for rental accommodation has increased by 21%, rising from 73 in January 2019 to 88 in January 2020.

Supply of rental stock

- The number of properties managed has fallen from 206 in December 2019 to 191 in January 2020.

- Supply has not been this low since July last year, at which point it stood at 184.

- Year-on-year supply is down from 197 in January 2019, but up from 184 in January 2018.

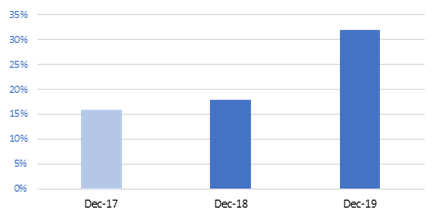

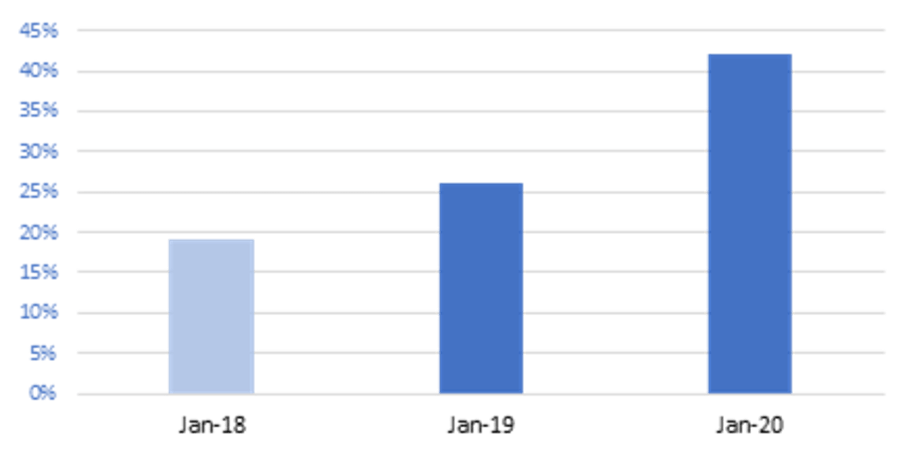

Rent prices

- The number of tenants experiencing rent increases rose in January. 42% of letting agents witnessed landlords increasing prices, compared to 32% in December last year.

- Year-on-year, this figure is up from 26% in January 2019 and 19% in January 2018.

David Cox, ARLA Propertymark Chief Executive, said: “This month’s results are a huge blow for tenants. With demand increasing by more than half, but rental supply falling, rent costs are unsurprisingly being pushed up.

“Our recent research found that tenants could miss out on nearly half a million properties as more landlords exit the traditional private rented sector and turn towards short-term lets which will only serve to worsen the problem for those seeking longer-term rental accommodation.

“With the Spring Budget around the corner, it’s important that the Government works to make the private rented sector attractive to landlords again, rather than introducing complex legislation which ultimately squeezes the sector and leaves tenants worse off.”