How will ban on letting agent fees impact landlords?

Today saw Chancellor Philip Hammond announce a ban of letting agent fees to be charged to tenants. Unsurprisingly, this move has not gone down well in the sector, with key industry peers fearing that these costs will instead be passed down to tenants.

However, research from TheHouseShop.com has revealed that the would-be financial impact on buy-to-let investors might not actually be as bad as first feared.

Fees

Data from the investigation shows that the average fees charged to tenants in Britain is around £300. In London, this figure rises to around £700.

Letting agents typically charge a buy-to-let landlord between 10-15% of their rental income for a thorough management service. Based on the average UK rent for October 2016 of £902 per month, this will amount to around £95 per month. This in turn is roughly £1,140 over the course of a year’s agreement.

When the additional cost of tenancy fees, (around £300) are factored in, this adds up to an extra £25 per month.

Returns

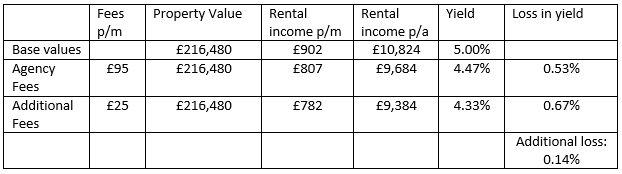

While this will undoubtedly leave some landlords upset, TheHouseShop.com feels it will not seriously harm their return on investment. Taking the average rent of £902 per month and the average UK yield of 5%, it has calculated the loss in rental income and yield from proposed increase in fees for landlords.

The results can be seen below:

Nick Marr, co-founder of TheHouseShop.com, notes: ‘The figures above show that even if letting agents are forced to pass on the costs of tenancy fees directly to landlords, it will not have a significant impact on the landlord’s overall yield and profits. In fact, the additional loss in returns could be as little as 0.14% when compared to the existing landlord fees structure.’[1]

How will ban on letting agent fees impact landlords?

‘Some landlords will undoubtedly raise their rents as a result of the ban – as we have seen in Scotland – but many will be able to absorb the costs of this new system without substantial losses, meaning tenants should not face a barrage of rent rises once the ban is in place. The other side of the argument here is that perhaps it should be the letting agents themselves who swallow the loss in fees, but tight margins in the High Street lettings market make this an unlikely scenario,’ he continued.[1]

Ban

Addressing the wider impact of a letting fees ban for both agents and landlords, Marr said: ‘Opponents of the proposed ban are claiming that a “short term fix” may seem appealing at first, but that in the long run it will be tenants who suffer as landlords raise rents to cover the higher costs of agency fees.’[1]

‘However, this is not necessarily true. The extra financial pressure on landlords will almost certainly result in them shopping around and trying to find the best price, and as landlords explore alternative options to the traditional letting agency service, I have no doubt that we will see a significant increase in the number of private landlords taking a more DIY approach to renting their properties.’[1]

Concluding, Marr stated: ‘It essentially comes down to a trade-off between convenience and costs, and good, reputable, hard-working letting agents will still be able to justify their costs to landlords.’[1]

[1] http://www.propertyreporter.co.uk/landlords/how-could-the-ban-on-letting-agent-fees-actually-affect-landlords.html