Rip-off student accommodation is leaving tenants battling

housing nightmares, unaffordable rents and poor mental health, according to the

2019 National Student Accommodation Survey.

The research, conducted by advice site Save the Student,

surveyed 2,196 students in January 2019. Their responses highlight a UK-wide

scandal of overpriced and unsafe student housing, with 90% reporting a problem

with their accommodation.

While fellow residents are a top cause of complaints, the

vast majority are maintenance issues that leave student tenants without basic

services or living in unsafe conditions – despite paying an average rent of

£125 per week (£541 a month).

Portsmouth student Adele describes having to live in

shocking conditions: “On move-in day, we

found there was no door on the front of the property, then we had no heating

for two months. We had a broken toilet, broken shower and rats/mice/fleas. An

open drain in the back garden would regularly overflow, just filling the garden

with sewage.

“Got to the point

where we called in the local housing association – turns out we had no gas

certificate, no fire door in the kitchen, and even the bannisters on the stairs

were unsafe!”

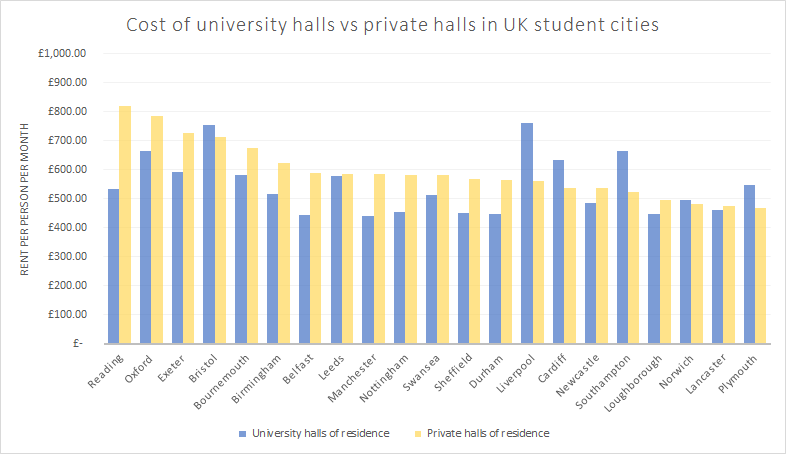

Housing nightmares

like these aren’t confined to cut-price accommodation – in fact, almost as many

students report problems with university properties and commercial halls of

residence as in private rental rooms and houses.

Kerry, a student in Bournemouth, comments: “Halls were a terrible experience. Building

work almost constantly, rats, and a very irritating flatmate who was loud and

disgusting and inappropriate.”

Save the Student’s

findings are particularly relevant, as the Homes (Fitness for Human Habitation) Act 2018 came into force yesterday (20th

March 2019). The new law gives students, as well as other private tenants, a

way to take action against landlords who ignore their legal responsibilities.

The ten biggest housing nightmares for

students

- Noisy housemates (45%)

- Damp

(35%)

- Housemates stealing food (33%)

- Lack of water/heating (32%)

- Disruptive building work (20%)

- Inappropriate landlord visits (16%)

- Rodents and pests (16%)

- Dangerous conditions (5%)

- Burglary (5%)

- Bed bugs (3%)

Asking for help with

housing issues is no guarantee that anything will be done, however. Although

half (45%) of students said that problems were resolved within a week, one in

five waited more than a month. A handful (4%) said that their housing

nightmares were never resolved.

Lily studies in

Newcastle: “Last year, I had no hot water for the entire year. I had to boil

the kettle and fill up the sink that way to wash my face.”

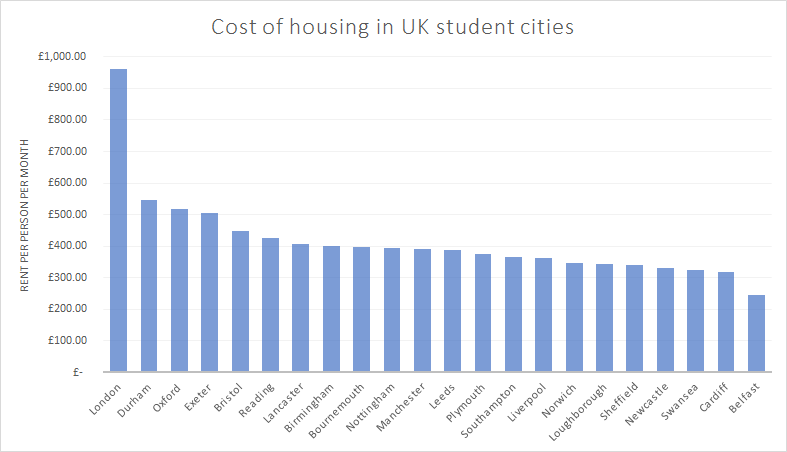

The cost of student accommodation

The pressure to find

decent housing is so high that one in three students start looking for next

year’s accommodation in or before November – that’s just weeks after the

beginning of the academic year.

This is brutal on finances, as students pay an

average of £970 in upfront housing costs: deposit (£311), admin fees (£119) and

a month’s rent in advance (£541). The stress on students and their

parents/guardians is even greater, as the typical maintenance loan – money the

Government awards for living costs – is just £541 per month.

Housing charity Shelter deems housing affordable

when costs are no more than 35% of a renter’s income. However, with the average

student rent eating up 100% of the typical maintenance loan, tenants are left

with no money to cover their other housing or living expenses.

As a consequence, half of all students struggle

to pay the rent, while two-thirds borrow from family, banks or other lenders to

cope with housing costs.

Parents/guardians who earn enough are expected

to contribute towards university living costs. However, this latest study

uncovers the burden on family finances. Parents/guardians contribute an average

of £44 per week (£2,288 a year) to help students pay their rent, but one in

five give more than £100 a week (£5,200 per year).

Banks are the next most common source of

borrowing, with 40% of students turning to overdrafts, loans or credit cards to

find the extra cash.

Students are therefore under immense pressure to

make ends meet, yet many are rewarded with housing that isn’t fit for purpose. The

consequences include stories of damp and mould-related illnesses, plus distress

caused by money worries.

Two-thirds (63%) of students said that housing

costs have affected their mental health, while 37% said that they have had an

impact on their studies.

Mark, in Sheffield, is only part way through his

course: “I have suffered from severe

depression and anxiety at university, and have undergone counselling and CBT [Cognitive

behavioural therapy] because of it.

“My parents help as much as they can, but it is hard for me to afford my rent

and living expenses on minimum student loan when my parents are putting two

other children through university. I had a part-time job, but that, plus

studying, was too much and made my mental health worse.”

Most troubling of

all, the National Accommodation Survey shows a clear link between money and

wellbeing at university. The more rent prices exceed the financial support on

offer, the more students suffer mental and financial stress.

Jake Butler, a

Student Money Expert from Save the Student, states: “Too many people –

including students – seem to believe that poor living conditions are just a

part of student life. Our investigation confirms how students are being

unfairly treated as if second-class citizens, expected to put up with dire

conditions throughout their studies.

“It’s even more outrageous considering the sums of money being handed over to

landlords. Rent swallows up the entire maintenance loan for many students,

piling on added stress of having to make ends meet while living in squalor.”

He adds: “Whilst the laws around renting are constantly improving, there needs

to be a much easier way for students to report and resolve problems with their

accommodation.”

Kelly-Anne Watson,

the Delivery Officer for student housing charity Unipol, continues: “It’s

imperative for ourselves, universities and students’ unions to be educating

students on their rights, and to give well informed advice on housing.

“We must work collectively as a sector to improve standards and make sure that

there are a range of varied rents for students to choose from, so there are not

further barriers into education.”

She urges: “We’d encourage providers to voluntarily join one of three national

codes: UUK, ANUK and Unipol. Within a code, it is unacceptable for landlords to

ignore reported issues, such as the third of students (from this survey) who

report living with damp, or without hot water and heating.”

Landlords, if you provide student accommodation,

ensure that your tenants aren’t living with housing nightmares!