Middlesbrough top of Zoopla’s table for rental yield hotspots in England

Zoopla has looked into England’s property hotspots to find the top ten areas for buy-to-let investors looking for the highest rental yields.

This research revealed that Middlesbrough came out on top for rental yields. It highlights that the large North Yorkshire town currently provides investors with a gross annual yield of 7.7%, thanks to the optimum combination of low property prices and steady median monthly rent of £450.

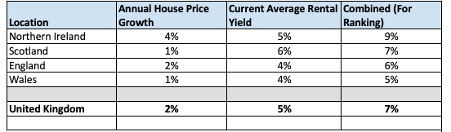

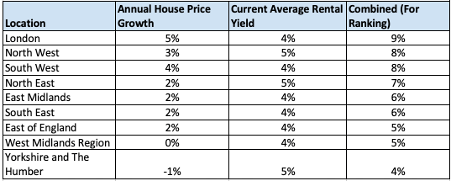

Zoopla has found that the recent stamp duty holiday has led to an increase in demand across the UK, but particularly in southern England. Here, investor demand had reduced the most over the last five years, following increased Stamp Duty rates and the withdrawal of tax relief for mortgaged investors.

Five areas in Scotland appear in the top ten, with East Ayrshire and North Ayrshire both providing investors with yields of 7.7%, based on a rent of £450. They are closely followed by Glasgow and Stirling, where yields are recorded at 7.6% and 7.5% respectively.

Zoopla reports high house prices meant that yields were lowest in the City of London at 3.1%, despite average monthly rents of £2,598.

The research comes as Zoopla launches its new Investor Zooploma, designed to offer a range of expert advice to buy-to-let investors on topics from rental yield and legalities, to financial liabilities.

Tom Parker, Consumer Spokesperson at Zoopla comments: “With all of the top ten hotspots being in northern England or Scotland, it’s clear that the significantly lower house prices that characterise these areas and come in well under the national average of £291,055, is playing in a role in the higher yields generated for investors.

“Yields are of course one consideration for investors and, for those considering their first foray into the buy-to-let market, it is worth considering house price growth forecasts for an area, and whether rents are likely to rise over time.

“With all those factors taken into account, now could be a good time to invest or expand a portfolio, with investors able to benefit from the stamp duty holiday – paying only the 3% levy – until March 2021.”

Zoopla’s Top Ten UK Investor Hotspots

| District | Gross yield (%) | 2 bed rent (Median, £PCM) | 2 bed capital value |

| Middlesbrough | 7.7% | £450 | £69,950 |

| East Ayrshire | 7.7% | £450 | £69,995 |

| North Ayrshire | 7.7% | £450 | £70,000 |

| Inverclyde | 7.7% | £476 | £74,500 |

| Glasgow | 7.6% | £792 | £125,000 |

| Stirling | 7.5% | £749 | £120,000 |

| Sunderland | 7.4% | £493 | £80,000 |

| County Durham | 7.4% | £428 | £69,500 |

| Nottingham | 7.3% | £792 | £130,000 |

| Hartlepool | 7.3% | £424 | £69,950 |