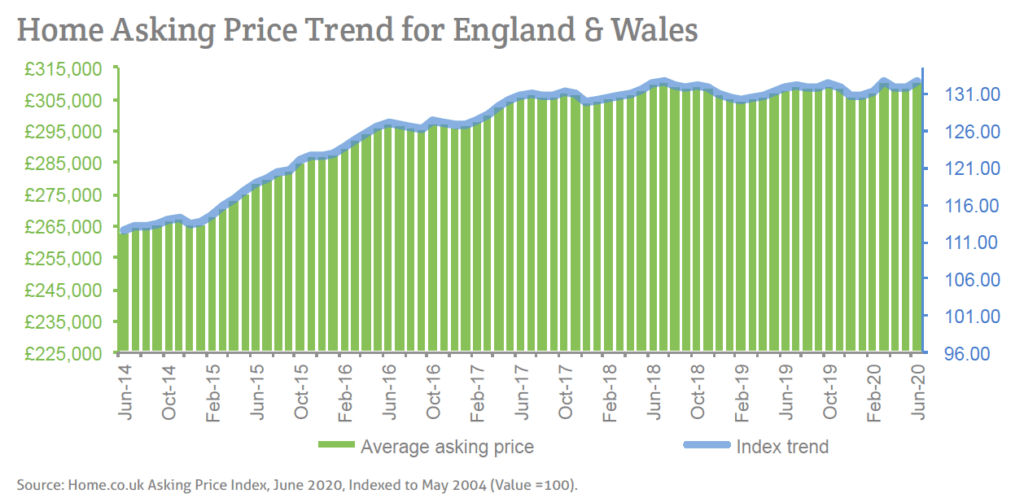

Higher prices reported in Home.co.uk’s June Asking Price Index

The latest Asking Price Index from Home.co.uk shows that vendors are re-entering the market with higher prices for June.

Home.co.uk says: “Counter to the doom and gloom that has dominated the media recently, vendors who have been brave enough to place their properties on the market are showing considerable confidence and less caution than might be expected.

“However, considering the overall lack of supply (there are only around 40% of the new listings one might expect for the month of May), their bullishness would seem justified.

“Supply was already low a year ago, according to longer-term trends, and the mere trickle of properties entering the market is highly unlikely to surpass demand.

“Moreover, it is clear that there is considerable pent-up demand post-lockdown, so much so that several major lenders have temporarily withdrawn 90% LTV products citing overwhelming demand, especially from first-time buyers.

“The fact is that the market is currently in a state of transition and the new normal is yet to be defined. We anticipate that it will take two to three months for the market to find its new post-pandemic equilibrium.

“Previously, we observed that the UK property market began the year with a plethora of encouraging activity and post-correction regions showed considerable potential for price growth.

“The optimistic scenario would be a return to this positive trend, although demand will certainly be tempered to some degree by a mortgage credit bottleneck and the economic damage sustained by the lockdown cannot be ignored.

“The key question remains ‘How vigorous will be the rebound be?’ Indications thus far suggest the market is taking off with an unprecedented sense of urgency.

“What is blatantly clear is that the situation could have been a whole lot worse. The annualised mix-adjusted average price growth across England and Wales currently stands at +0.8%; in June 2019, the annualised rate of increase of home prices was -0.6%.”

Asking Price Index headlines

- Supply of new sales instructions ticks up across the UK in May (but is only 43% of the May 2019 total) as the lockdown eases.

- Vendors braving the market are confident and are pricing much higher, safe in the knowledge that supply is very low.

- Consequently, the mix-adjusted average for England and Wales has jumped 0.7% since the May reading.

- The North West and Yorkshire show confident price hikes of 1.5% and 1.3% respectively since last month.

- The supply rate of new instructions has recovered the most in London and the least in Scotland.

- The best-performing regions, the North West and Yorkshire, show the lowest rises in Typical Time on Market aside from London and have year-on-year price growth comfortably surpassing that of monetary inflation (3.4% and 3.2% respectively).

- The total sales stock on the market across England and Wales has increased slightly since last month but is still significantly down; 14% year-on-year.

- East of England remains the UK’s worst-performing region with the average asking price 1.7% lower than twelve months ago, although a jump of 0.9% this month shows that confidence is rapidly returning.

- Supply in the rental sector across the UK recovers slightly but remains 15% down year-on-year.

View the full report here: www.home.co.uk/asking_price_index/HAPIndex_JUN20.pdf