Landlords Calling for Overhaul in Universal Credit Payments

The Scottish Landlords Association (SAL) is calling for the housing portion of Universal Credit (UC) benefits to be paid directly to landlords.

In its current form, UC is paid, in full, to tenants who must then pay landlords themselves. Whilst claimants do have the option to have the housing element sent directly to landlords, this is not the norm, with

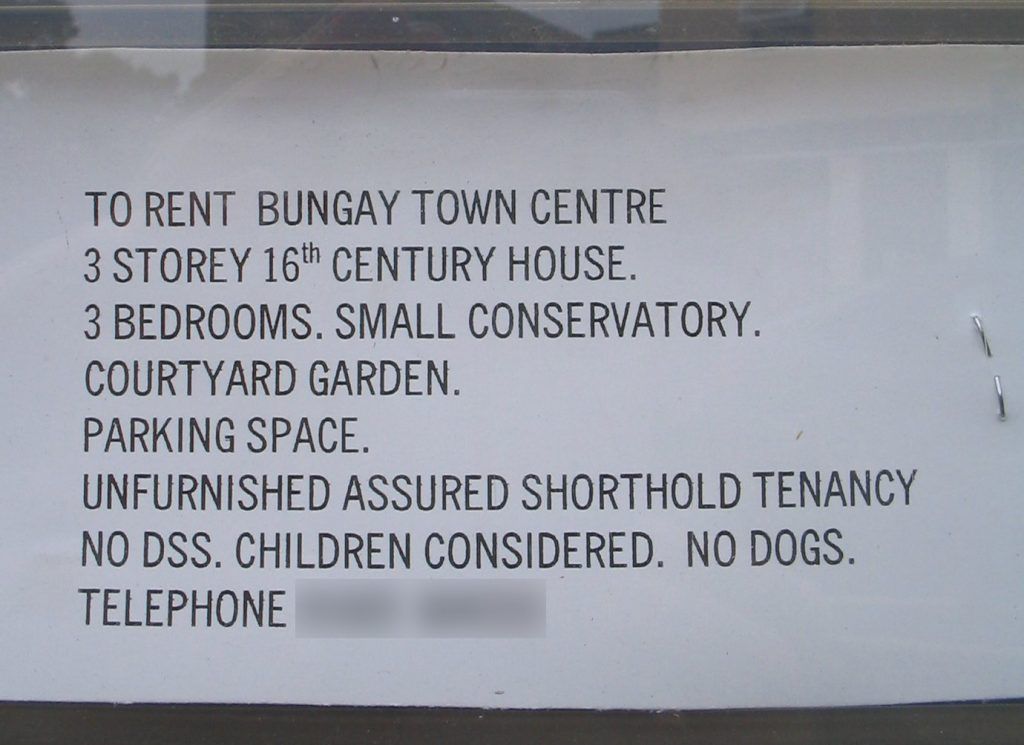

The issue forms part of a wider criticism against Universal Credit, which has seen numerous campaign groups arguing that the rollout is making claimants worse off and discouraging landlords from letting to them.

Simon Graham, the director of SJ Lettings, based in Buxton, Derbyshire states: “In theory, universal credit is an empowering idea, encouraging people to learn to budget for themselves, but for the more vulnerable tenants, being given £600 at the start of the month and expecting them to make it last until the next month is just not realistic.”

By removing this middle step, both delays and uncertainty that landlords can experience when letting to tenants in receipt of housing benefits would be reduced.

The Social Security Committee of the Scottish Parliament agrees, stating that this change would ensure that all tenants would have equal access to rented accommodation, regardless of how they pay for it. Unfortunately, as of yet, The Scottish Government has not taken the opportunity to make any changes to the way UC is paid.

John Blackwood, chief executive of SAL said: “What we are proposing, and the committee report agrees with, is that the default position would be that the housing component of Universal Credit is paid directly to the landlord, private or social, but the tenant would still be able to opt-out if they wanted. This would reduce the risk to landlords of renting to those on Universal Credit and ensure those in receipt of benefits are treated fairly and equally as they deserve to be.

“The government is expected to formally respond to the Social Security Committee’s report over the summer and I hope they will reflect on their conclusions and join private and social landlords as well as charities and others who support this measure so together we can persuade the UK government of our case.”