Planning on Turning Your Rental Property into a Holiday Let?

From the tax changes to mortgage interest relief to the current proposals to introduce a minimum three-year contract for rental tenancies, landlords have been receiving a lot of stick recently.

It’s no surprise, that due to this, landlords are contemplating alternative options concerning the generation incomes from their properties.

For some, the best option has been to turn to commercial building, such as offices and shops. However, for others, it is the letting terms, rather than the properties, that they are choosing to change.

Research undertaken by the RLA last year discovered that there had been a 75% rise in the number of London landlords listing more than one property on Airbnb between February 2016 and March 2017.

Meanwhile, recent figures from the Office for National Statistics revealed the total number of holiday lets increased by 5.5% in 2016-17. This occurred at around the same time when landlords were being hit with harsh Government measures.

Lisa Evans, Commercial Property Solicitor at Kirwans law firm, commented: ““Landlords are undoubtedly going through a really tricky time right now.

“Punitive tax changes and the introduction of endless red tape has hit landlords hard, and many are doing all they can to find their way to retain their income without having to go through the process of offloading their properties.

“For some, turning rental homes into holiday lets where appropriate can seem like the answer to their prayers, offering higher yields than traditional buy-to-lets and retaining the right to claim mortgage interest tax relief.

“However, as with any investment, there are always important points to consider.”

Lisa then sets out some key points to consider prior to turning your rental properties into holiday homes:

1) Check that your mortgage lender allows you to do so

Your first port of call should be your mortgage lender to enquire as to whether you need to change your mortgage to allow you to do so; otherwise you could face a higher mortgage rate, fine, or even demands of immediate repayment or threats of repossession.

2) Prepare for higher mortgage repayments

If you do need to change to a holiday let mortgage, you could face an early payment penalty fee, as well as higher rates from the limited number of lenders who offer such mortgages.

3) Don’t forget to change your insurance

Changing your property to a holiday let could make your buildings and contents insurance invalid, so contact your insurance company to find out what you need to do to ensure your property continues to be protected.

4) Check whether the property is leasehold

If so, go through the lease with a fine toothcomb and check that you’re permitted to use the property as a holiday let, or you may fall foul of the law.

5) Be strict about the number of guests

If there’s a possibility that you might let the property to more than four people, then you may need to obtain an HMO licence. Overlooking this important fact could result in prosecution and a huge fine.

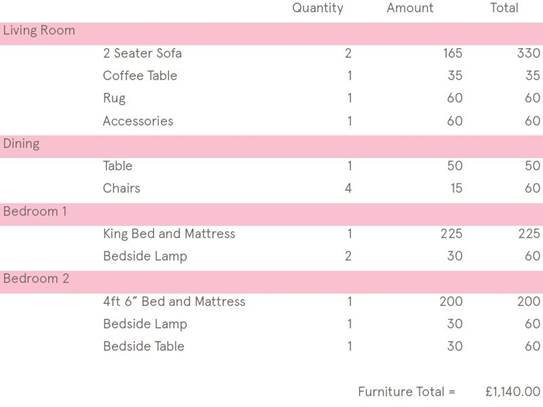

6) Do your sums

As with buy-to-lets, there’s a good chance that there’ll be a period of the year when your holiday let is unoccupied, so you need to make sure that it makes enough income the rest of the year to cover these quiet times. Do your sums and make sure that the rent can cover any shortfall.

And if you’re thinking of selling up and buying a holiday let instead . . .

Choose your location carefully

The pretty, chocolate box cottage may look beautiful, but if it’s miles away from the nearest shop you may find that tourist interest is low. Conversely, the property you’re interested in may be in a holiday hotspot, but if it is ugly or visually unappealing, there may be surprisingly few enquiries. Think about the elements you’d look for if you were the customer, and try and choose a property that’s both in a busy tourist area and looks pretty too.