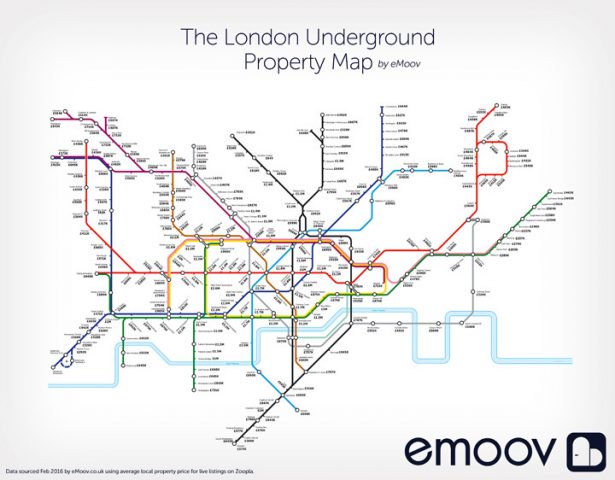

The Average House Price at Each London Underground Station

Are you looking to invest in the London property market ahead of buy-to-let tax changes this year? Or maybe you’re one of the homebuyers looking to take advantage of the London Help to Buy scheme, which launched on Monday?

Whichever way you’re going to buy, if you’re considering the property market in the capital, it is vital that you pick the best place to purchase.

Thanks to online estate agent eMoov, you can now compare house prices across the London Underground with the firm’s alternative Tube map.

For each of the 280 stations on the Underground, eMoov has found the average house price in that area.

Last year, we published a similar map, which shows how much it costs to rent near each Tube stop. And the two maps show some similarities…

Take one of the cheapest rental prices for example. Renting in Hatton Cross cost just £324 per month back in September, and indeed, it is still one of the cheapest places to buy this year, with house prices around £292,000.

Dagenham Heathway also has some affordable properties – the average house costs just £238,000. However, renting in this area was more expensive last year, at £796 a month.

While not all rent prices/house prices correlate, expensive spots are pricey across all tenures.

Properties in Hyde Park Corner go for an average of £1.9m, while tenants will need a huge £2,920 per month to rent there. However, rents are cheaper in Piccadilly Circus, at £2,256 a month, while house prices average a whopping £2.6m.

Landlords are reminded that buy-to-let investors and second homebuyers will be charged an extra 3% in Stamp Duty after 1st April, which is causing many investors to rush into the market now in order to beat the deadline. Find out more: /landlords-rushing-to-avoid-buy-to-let-tax-changes/

Those looking for help with saving for a deposit can apply for Government-backed equity loans of up to 40% of a new build property’s purchase price worth up to £600,000 through the Help to Buy London scheme. For more information visit: /help-to-buy-london/

Use the map to find out where you can afford to buy: https://media.timeout.com/images/103113857/image.jpg