UK rents catching up with those in London

The most recent report from Countrywide has shown that the average London rent was 0.7% lower than last year in November. This was the largest fall seen since October of 2010, where rents stood at an average of £901 per month.

During the last year, London has moved from the region with the second largest rate of rental growth in the UK, to the slowest.

Closing Gap

Over the past five years, the gap between rents in London and the rest of the UK has grown substantially. By 2015, this gap had risen to a record £490 per month, an incredible rise from the £150 per month recorded in 2010.

However, rents in the capital are now growing at a slower rate than the rest of the UK, meaning that the gap between London and the rest has now closed. By November 2016, this gap had fallen, the first drop since 2010. Rents in London now stand 60% higher than in the rest of Great Britain.

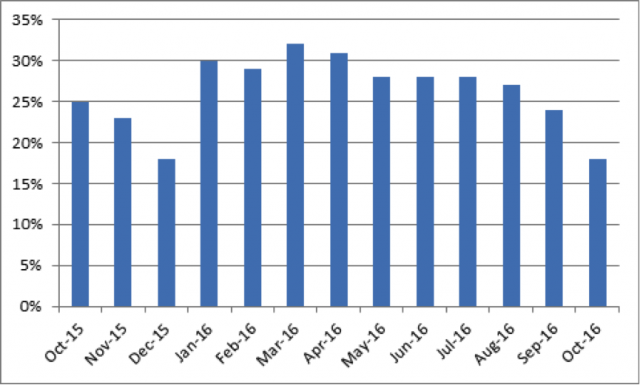

This narrowing rent gap has been driven by a rise in the number of homes available to rent in the capital. During November 2016, there were 32% more homes to rent in London than at the same period in 2015. In addition, the number of would-be tenants increased by 9%. Average asking rents in London were down by 11%, more than double the proportion seen in 2015.

Across Britain, the cost of a new let increased by 2% in the last year-3.1% if London is excluded. Rental growth has been driven by the North, North East and North West of England, alongside Yorkshire and the Humber. 25% of tenants renewing their contract in the North of England saw their rent increase in November, up from 16% in the same month last year.

UK rents catching up with those in London

Boost

Johnny Morris, research director at Countrywide, noted: ‘Higher than usual numbers of homes available to rent has boosted tenants’ negotiating power. Stock growth has outstripped that of tenants. This is in part due to the hangover from the rush to beat the 3% stamp duty charge earlier in the year and a shift in stock from the sales market. With more choice and facing stretched affordability, many tenants are using their new found negotiating power to agree lower rents than in 2015.’[1]

‘Since the gap between London rents and those in the rest of the country hit a high watermark in 2015, the gap has been gradually narrowing. The pressure on affordability and number of homes coming onto the rental market in the capital means that rents are likely to lag behind the rest of the country in 2017,’ Morris added.[1]

[1] http://www.propertyreporter.co.uk/property/rest-of-uk-catching-up-with-london-rents.html