Property price sentiment continues to be strong

The most recent report from Knight Frank and IHS Markit has revealed that during March, the majority of UK households believed the value of their property increased.

According to the investigation, this was the eighth straight month that the Index was positive.

Values

Respondents in nine out of eleven regions covered by the Index feel that the value of their home has increased over the last month. Those in the South East were most positive.

Overall, households in all regions believe that the value of their home will increase during the next year.

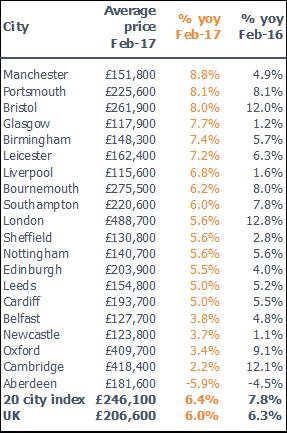

Oliver Knight, an associate in the residential research team at Knight Frank, said: ‘The latest survey data suggests that house price sentiment across the UK is becoming steadier. Households still report that values are increasing, but at a more modest pace than before the EU Referendum, which is consistent with wider housing market trends.’[1]

‘Future price expectations remain in positive territory, especially in the South and Midlands, but there are a number of headwinds which could weigh on the market, including rising inflation and second-round effects from Brexit. Yet at the same time, a lack of supply of housing for sale is underpinning pricing across much of the UK,’ he continued.[1]

Property price sentiment continues to be strong

Upbeat

Tim Moore, senior economist at IHS Markit, noted: ‘UK house price sentiment was relatively upbeat in March, which provides another signal that confidence has gradually picked up during the first quarter of 2017. This suggests that ultra-low mortgage rates and the resilient UK labour market are helping to offset the drag on house price sentiment from squeezed consumer finances.’[1]

‘While sentiment has rebounded strongly since last summer, house price expectations are still much more subdued than those reported in the three years leading up to the EU referendum. Looking at house price expectations for the next 12 months, regional divergences widened across the UK during March. In particular, household sentiment in Scotland fell to the weakest for over four years, and the gap relative to UK-wide price expectations was the greatest since the survey began in 2009,’ he added.[1]

Concluding, Mr Moore said: ‘Meanwhile, the latest survey saw London drop into the bottom half of the UK regional table for the first time since April 2010. By contrast, people living in the West Midlands were more confident about the outlook for their property values than at any time in the past two-and-a-half years.’[1]

[1] http://www.propertyreporter.co.uk/property/house-price-sentiment-strengthens.html