Despite the stamp duty holiday reducing the average of tax to be paid on a buy-to-let property, landlords have seen the profitability of their investments shrink by 17%.

This information comes from the latest research by Howsy, the lettings management platform. The results show that the actual cost of being a landlord still requires 65% of an average buy-to-let income. This takes into account void periods, mortgage interest, management fees, and maintenance.

Initial investment costs are down by 23%

Chancellor Rishi Sunak’s stamp duty holiday has meant that the initial cost of Stamp Duty Land Tax has fallen by 26%. This reduced cost of £4,957 combined with the average tenant finding fee of £827 results in the initial price of investing in buy-to-let dropping by 23% year on year.

Ongoing buy-to-let costs are down by 10%

Howsy has also reported a reduction in the ongoing costs of running a buy-to-let property by 10%.

The average landlord experiences 23.75 days of void periods each year, reducing rental income by £538 on an annual basis, Howsy reports. On top of this, agency management fees have increased by 2% since last year, now costing an average of £992 a year.

However, mortgage rates have been favourable in some places. Seeing the interest paid on money borrowed drop by 10% in the last year. Howsy says the 73% of landlords that buy with a mortgage are now paying out £6,232 in annual interest, compared to £6,921 a year ago.

The average annual maintenance and repair bill for a buy-to-let has also dropped 20% year on year, now at £1,652.

Looking at overall ongoing running costs, this figure averages £9,414. Howsy notes that this is a sizeable sum, but one that has decreased by as much as 10% when compared to last year.

Buy-to-let income is down by 13%

Although initial and ongoing costs have fallen, this is also the case for the profitability of buy-to-let investments.

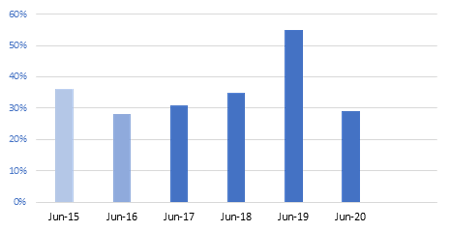

Rental yields are now at an average of 5%, with landlords seeing a 2% increase in annual rental income. However, the average rate of bricks and mortar capital appreciation over the last ten years has decreased. It is now down from 4.70% during the previous year to 3.81%. This results in the value of buy-to-let properties only increasing an average of £6,296 in 2020, compared to £8,614 last year.

Taking into consideration capital appreciation and annual rental income, the average buy-to-let property is currently bringing an overall return of £14,564, which is a 13% decrease on last year’s £16,726.

The remaining profit

After deducting start-up costs, ongoing costs, and unforeseen events, such as the possibility of evicting a tenant, landlords are looking at an average profit of £5,150.

Howsy summarises that the ongoing costs account for 65% of their buy-to-let income, resulting in profitability falling 17% in the last year.

Founder and CEO of Howsy, Calum Brannan, commented: “It’s great to see that the government has finally provided landlords with a momentary financial reprieve in the form of a stamp duty reduction.

“However, our research shows that overall, buy-to-let profitability is still down year on year, and more must be done to help stimulate the backbone of the rental market.

“Of course, bricks and mortar remain a very sound investment, and in many pockets of the market, the return is far higher than that of the average landlord. But we need to do more to encourage landlords to return to the market at all tiers and in all areas to meet the massive demand from tenants for rental homes.

“Luckily today, the integration of technology into the lettings space means there are ways to increase profit margins. Online lettings platforms allow for a much more affordable management fee with greater accessibility.

“While additional products such as Howsy Protect not only provide a guaranteed source of rental income, but they also protect against unforeseen damages to your investment, as well as providing additional peace of mind with appliance cover, home emergency and boiler cover, plus much more.”