Home » Uncategorised »

Will the Tenancy Deposit be a Thing of the Past?

This article is an external press release originally published on the Landlord News website, which has now been migrated to the Just Landlords blog.

Every year, £3 billion worth of tenants’ money is registered with one of three deposit protection schemes, as is legally required of landlords. But is there an alternative for savvy investors?

In most cases, a tenant’s deposit is handed back to them – less than 1% of the money is disputed. Reposit, a new service that could help landlords, believes that tenancy deposits not only put a financial strain on tenants in an increasingly expensive rental market, but also breed distrust.

“Ten years ago, you would have been laughed out of the room if it was suggested the idea that people would allow complete strangers from across the world to use their homes for accommodation while they were on holiday,” the firm notes. “Now, Airbnb has pioneered the sharing economy model and proved that, with a few exceptions, we can trust people.”

This led Reposit to ask the question: “So why do landlords take a deposit?”

It is generally understood that if a landlord holds a tenant’s deposit, the renter will be more inclined to look after the property.

However, Reposit has a different idea.

The new, innovative product seeks to abolish the need for a landlord to take a tenancy deposit.

The CEO of Reposit, Curran McKay, explains: “A tenant moving into their new rented home must find a month’s rent up front – six weeks’ rent as a holding deposit – as well as letting agency fees. On the other hand, a landlord wants some assurance they will be covered in the worst-case scenario. We believe trust, with a little help from Reposit, is all that it takes.”

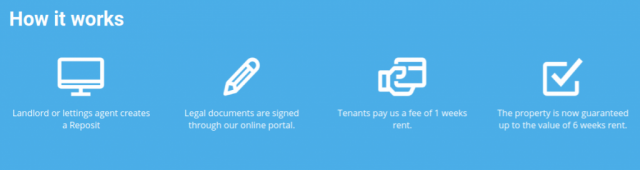

So how does the product work?

Will the Tenancy Deposit be a Thing of the Past?

- A tenant pays one weeks’ rent to Reposit as a fee, saving significantly on the average six-week deposit.

- If the tenant damages anything during the tenancy (save for fair wear and tear), or has unpaid rent arrears or cleaning costs at the end of the tenancy, they will be liable to pay this amount up to the maximum of six weeks’ rent to Reposit.

- Reposit will then pay the landlord or appointed agent the full owed amount.

- If there is a dispute, the firm has an independent Alternative Dispute Resolution (ADR) specialist to look at the case, using the same professionals as the three Government-approved schemes.

- If the tenant breaks anything, they pay for it. Simple!

Under the current deposit system, landlords must, by law, register the tenant’s deposit within 30 days of receipt, or face a fine of three months’ rent. This can also cost the landlord time and money.

Under Reposit’s system, landlord would not need to take a deposit, while still being protected with cover equal to six weeks’ rent as standard.

For more information, call Reposit on 020 3868 4070 or visit https://getreposit.uk.