Home » Uncategorised »

The Difference in Age Range and Homeownership

This article is an external press release originally published on the Landlord News website, which has now been migrated to the Just Landlords blog.

With renting the most likely housing option for young people today, how common is homeownership amongst this generation and the older generation?

The Guardian has released an infographic that details changes in the market over many years.

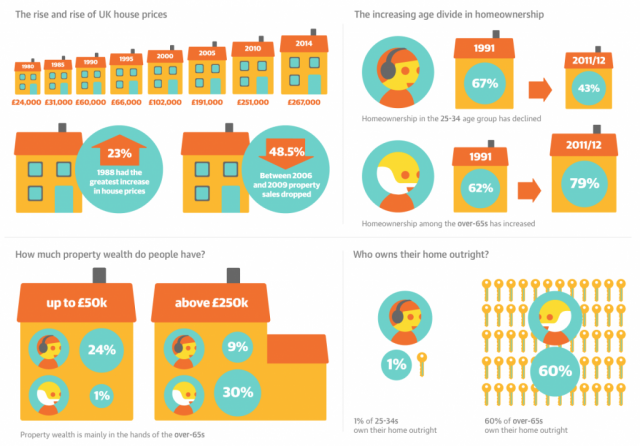

Shockingly, the newspaper details the growth of house prices since 1980. In 35 years, the average property price has risen from just £24,000 to £267,000.

Considering that the average first time buyer deposit is now over £25,000, this highlights the increasingly difficult position they are in, compared to the previous generation.

However, the greatest increase in house prices came in 1988, a rise of 23%.

But this didn’t halt buyers as much as in the period between 2006-09, when house sales dropped by a huge 48.5%, showing the real impact of the financial crisis on the housing market.

Looking at the age divide in homeownership, the results are equally as staggering.

In 1991, more people in the 25-34 age group owned a home than those aged over-65, at 67% to 62%.

By 2011-12, this had changed dramatically. Just 43% of 25-34-year-olds owned a home, compared to 79% of over-65s.

Considering assets, 24% of 25-34-year-olds have up to £50,000 in property wealth, compared to 1% of over-65s.

Those with property wealth of over £250,000 drops to 9% in the 25-34 age range, but up to 30% in over-65s.

A huge 60% of over-65s own their home outright, compared to a minute 1% of 25-34-year-olds.