Landlord confidence is seemingly bouncing back

A new report has revealed that landlord confidence has returned, following a turbulent few months. Investors are now looking to secure mortgages through limited companies, with many also increasing rents in reaction to the tax assault on the sector.

The investigation from Kent Reliance reveals that landlords’ confidence is at its greatest level for a year. 54% of investors are confident about the prospects for their portfolios. The survey quizzed around 900 buy-to-let investors and reveals confidence is higher than in the second quarter of 2016, when just 39% said that they were optimistic.

Incorporation and rent rises

Property investors have been forced into taking action as a result of the additional tax costs that they will face in 2017. Alterations to mortgage interest tax relief and the ban on letting agent fees are likely to push more landlords towards incorporation. Research from Kent Reliance indicates that there have been more than 100,000 limited company loans taken out so far in 2016. This is already double the amount in 2015.

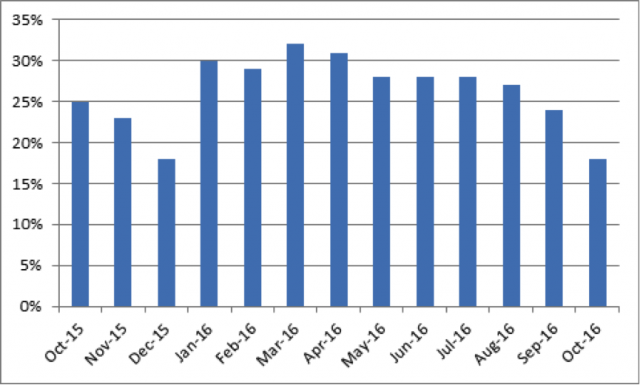

Rents have also been pushed up by the upcoming tax changes. The average rent for Great Britain now stands at £881 per month-a record high. This comes despite the supply of rental property hitting an 18 month high. Rents were found to have risen by 2.4% over the course of the last 12 months.

It is estimated that in total, landlord are collecting £4.6bn in rent every month.

2017 is expected to bring an acceleration in rental prices. One third of landlords are expected to increase their rents by an average of 5.4% in the next 6 months. Two-thirds said this is due to the threat of higher taxes.

In addition, the sector is likely to see extra pressure from the Prudential Regulation Authority, with new underwriting standards due for implantation next year.

Landlord confidence is seemingly bouncing back

Taking its toll

Andy Golding, Chief Exceutive of OneSavings Bank, noted: ‘Property investors have had to roll with punches in 2016. The stamp duty levy clearly took its toll on the market, and combined with the forthcoming tax changes, landlords have felt at the mercy of a political agenda. But confidence is returning as landlords take action to limit the damage to their finances. The use of limited companies is soaring, and rents are increasing, even after one of the biggest surges in rental supply in recent history.’[1]

‘There is still more to come for the buy to let sector next year. The PRA’s new underwriting standards are due to be implemented, the tax changes begin to take effect, and there is yet more potential intervention in the form of the FPC’s new powers. If the cumulative effect of constant change undermines the expansion of rental properties, this will simply exacerbate the housing crisis, he continued.[1]

Concluding, Mr Golding observed: ‘Only through a substantive and long-term building programme across all tenures will we see an end to escalating house prices and rents. The Chancellor has moved to provide more support for house building, but it is not yet enough to see the step-change in supply that we need.’[1]

[1] http://www.propertyreporter.co.uk/landlords/landlord-confidence-at-a-high-following-government-intervention.html