Increasing rents for larger homes continued into last quarter of 2020, says The DPS

UK rent levels continued to rise faster for larger properties during the last quarter of 2020, according to the latest edition of The Deposit Protection Service’s (The DPS) quarterly Rent Index.

The Rent Index is based on its database of 1.8 million current tenancies and 13 years of data. It shows that the average monthly cost of renting a detached property in the UK between October and December 2020 was £1,055. This is £29 (2.83%) more than in Q3 2020 and £57 (5.71%) more than Q4 2019.

The average rent for semi-detached homes increased to £847 in Q4 2020. This is £19 (2.29%) more than in the previous quarter (Q3) and £33 (4.05%) more than in the same period the previous year (Q4 2019).

It has been recorded that the cost of renting a flat has increased at a much slower rate than that of renting larger properties. This is despite the cost of renting a flat increasing at a faster rate in Q4 of 2020 than at the beginning of that year.

| Average rent by property type | |||||

| Property type | Q4 2020 | Q3 2020 | 2020 Q4 vs 2020 Q3 % change | Q4 2019 | 2020 Q4 vs 2019 Q4% change |

| Detached | £1,055 | £1,026 | 2.83% | £998 | 5.71% |

| Semi-detached | £847 | £828 | 2.29% | £814 | 4.05% |

| Flats | £803 | £795 | 1.10% | £794 | 1.13% |

| All | £792 | £780 | 1.54% | £773 | 2.46% |

Matt Trevett, Managing Director at The DPS, comments: “Lockdown has meant many more people are spending longer at home, including far more extensive remote working, and as a consequence more tenants are seeking larger properties with more space.

“While there seems to be a particular focus on detached and semi-detached properties, the rental market as a whole remained remarkably resilient throughout much of 2020, despite broader economic uncertainties and restrictions that affected home viewings and public movement during the first national lockdown.”

Paul Fryers, Managing Director at Zephyr Homeloans which, like The DPS, is part of the Computershare Group, said: “Zephyr Homeloans saw a significant increase in buy-to-let mortgage applications in the last half of 2020, further suggesting a continued overall resilience in the UK rental market.

“Increased demand for detached and semi-detached properties will be of particular interest to the sector, with both landlords and tenants looking to adjust to the new circumstances that the pandemic has brought.”

The DPS said that average overall UK rent increased to £792 during Q4 2020, which is £12 (1.54%) more than in Q3 2020 and £19 (2.46%) more than Q4 2019.

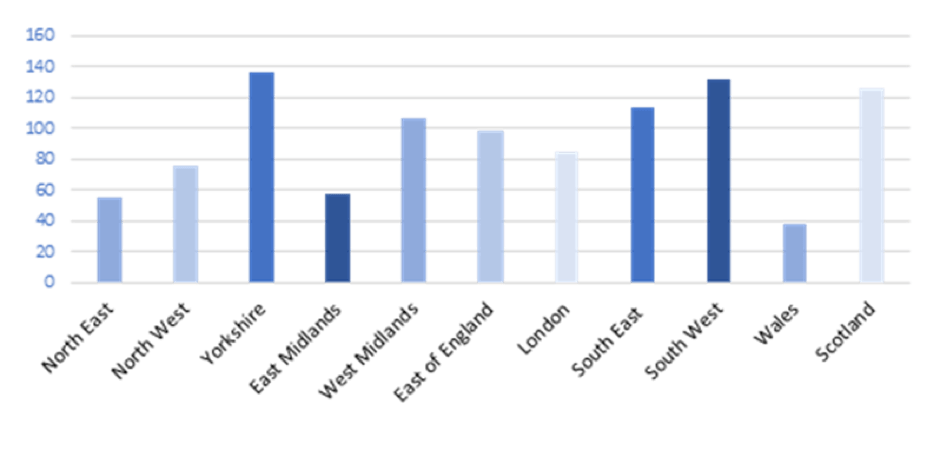

Regional figures

London rents continued to drop during the period, standing at £1,317: £5 (0.38%) lower than in Q3 2020 and £28 (2.08%) less than Q4 2019.

This drop was biggest in Central London, where average rent was £1,377 in Q4 2020: £54 (3.77%) less than during the same period in 2019 (£1,431) and £14 or 1.01% less than Q3 2020.

The capital remains proportionately the most expensive area in which to rent property, with costs standing at 39% of average UK income.

Two other regions experienced a decline in average rent between Q3 and Q4 2020 – the North East, where it fell by £9 (1.70%) to £520, and Yorkshire, where it fell by £12 (-2.15%) to £546.

The West Midlands experienced the largest percentage rise (£24 or 3.85%) during Q4 2020, reaching £647.

The North-East remained the cheapest region during Q4 2020, with rents accounting for 23% of average UK income.

| Region | Average Rent Q4 2020 | Change since Q3 2020 (£) | % Change since Q4 2019 |

| London | £1, 317 | -£5 | -2.08% |

| South East | £923 | £23 | 5.25% |

| South West | £780 | £18 | 4.56% |

| East | £831 | £16 | 0.97% |

| East Midlands | £612 | £13 | 5.15% |

| West Midlands | £647 | £24 | 5.89% |

| Yorkshire | £546 | -£12 | 4.20% |

| North West | £616 | £10 | 3.36% |

| North East | £520 | -£9 | 0.39% |

| Scotland | £652 | £19 | 6.54% |

| Wales | £606 | £14 | 2.89% |

| NI | £551 | £15 | 0.55% |

For the full report, visit The DPS’ blog: https://depositprotection.com/news/latest-news/2021/average-rents-grow-throughout-2020-the-dps-rent-index-q4-2020/