Young Tenants Cannot Afford to Start a Family in Two-Thirds of the UK

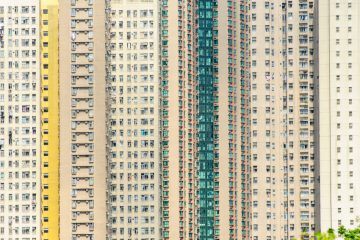

New research from The Guardian has found that young tenants living in private rental accommodation cannot afford to start a family in two-thirds of the UK.

Those living in Birmingham, Edinburgh, Bristol and the whole of the South East would struggle financially to have children, as a large proportion of their income is spent on rent.

The Guardian, alongside tenant lobby group Generation Rent, used the average regional full-time wage for workers in their 20s and 30s and the cost of renting a two-bedroom home in the area to conduct the study.

They found that young couples would have to spend more than 30% of one full-time worker’s wage to keep a roof over their heads in 66% of the country.

There is no official definition of what affordable housing is in the UK. However, housing charity Shelter believes it amounts to 33% of income, while the National Housing Federation puts it at 25%.

In the USA, the Department of Housing states that affordable homes take up 30% of income.

The Guardian’s findings have renewed calls from MPs and campaigners for rent caps to be introduced, after being abolished more than 20 years ago.

The study found that the only areas still affordable for young families are the North West, North East and Yorkshire and the Humber. Northern Ireland is also affordable when measured against the average income for all age groups; there are no separate figures for young workers in Northern Ireland.

The most expensive place for those hoping to start a family is London, where a two-bed rental property costs 60% of the average income for someone in their 20s and 44% for those in their 30s. The capital is followed by the South East, South West and the East of England for unaffordability.

The Director of Generation Rent, Betsy Dillner, says: “For people on modest incomes, having a child will normally involve one parent staying at home while the other works full time, for a period longer than parental leave normally covers.

Young Tenants Cannot Afford to Start a Family in Two-Thirds of the UK

“That means a typical new family will rely on one full-time salary to make ends meet. If the rent is too high, that makes the arrangement unviable.”

For those on lower incomes, Dillner explains: “The situation is even worse, with constant anxiety over how to put food on the table, and nothing left at the end of the month to put aside for the future.

“Not only do young adults face renting for a longer period at a higher cost than their parents, and may never actually buy a home, they are less likely to start a family – a prospect that ought to terrify older generations and policymakers alike.”

She believes that if local leaders don’t want to see their communities destroyed by the housing crisis, they must start building homes on the “uglier parts of the green belt”1 and introduce rent controls.

The call for building on the green belt and rent caps was supported by Labour MP Frank Field, the Chair of the House of Commons Work and Pensions Committee, which recently set up an enquiry into intergenerational fairness.

He claims that “one emergency option” to solve the housing crisis “would be to consider capping rents at an affordable rate for young families seeking their first home”.

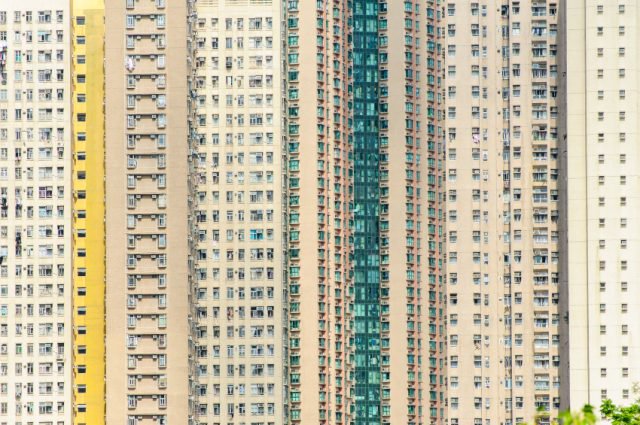

A further study by Ipsos Mori reveals the extent of the huge generational shift in UK housing tenures in the last 15 years.

Millions more millennials – today’s adults born after 1980, also known as Generation Y – are being forced into private renting than the generation before them, it found.

Analysing decades of data from the British Social Attitudes survey, Ipsos Mori discovered that in 1998 – when the average member of Generation X (those born between 1965-1979) reached 27-years-old – 55% of them were homeowners, while just 24% rented from private landlords.

In 2014, when the average millennial was the same age, only 32% were homeowners and 45% rented privately.

There has also been a surge in the number of millennials living with their parents. The Ipsos Mori research found that this shift is underlined by educational disadvantage – millennials living with their parents are half as likely to have a degree, a correlation that was not evident among Generation X.

Although income growth for young adults in the UK has fared well over the last 30 years by international comparison, the cost of housing – particularly in the private rental sector – is putting huge financial strain on young tenants looking to start a family.

Field insists: “The only sustainable way to improve those families’ chances of gaining suitable accommodation, and prevent their children growing up in an overcrowded home, is to increase the supply of houses that are genuinely affordable.

“This programme will necessarily need to encroach onto some of the grubbier parts of the green belt and, for it to be effective, will have to be accompanied by a renewed effort to control our borders. Failure to act on any of these fronts could cast a whole generation adrift from the housing market.”1

In response to The Guardian’s findings, the Chief Executive of the National Landlords Association (NLA), Richard Lambert, says: “The cost of housing is high for everyone at the moment, whether you rent or have a mortgage, so frustration about affordability is understandable. However, rents alone are not to blame. They have risen broadly in line with inflation over the past decade.

“Affordability is being eroded largely because the demand for housing greatly outstrips supply, and because salaries aren’t rising in line with inflation.”

He adds that the long-term solution is to build more homes, especially in the social sector.

“Instead, the Government is preoccupied with championing homeownership, leaving those genuinely in need of affordable rented housing left clinging to tired political rhetoric like rent controls.”1

Yesterday, we revealed that the average rental property achieves 99.9% of its asking price, indicating how strong demand is when compared with supply.

A spokesperson for the Department for Communities and Local Government states: “We’re determined to create a bigger, better private rented sector – attracting billions of pounds of investment to build homes specifically for private rent – increasing choice for tenants.

“We’ve also doubled the housing budget to support the boldest housing programme by any government since the 1970s, with £8 billion committed to build 400,000 affordable homes over this Parliament.

“We are doing all of this without the need for excessive state regulation that would destroy investment in new housing, push up prices and make it harder for people to find a flat or house to rent.”1

For all of your responsibilities and information for landlords, remember to check LandlordNews.co.uk daily.

1 http://www.theguardian.com/world/2016/mar/14/young-families-priced-out-rental-markets-in-two-thirds-uk