Home » Uncategorised »

London Tenants Spending 70% of Their Income on Rent and Bills

This article is an external press release originally published on the Landlord News website, which has now been migrated to the Just Landlords blog.

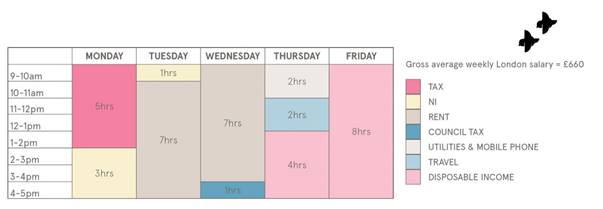

London tenants are now spending 70% of their average income on rent and essential bills, according to research by London estate agent Portico.

New data analysis by the firm shows that for three-and-a-half out of five working days, Londoners work solidly to pay their rent and other essential expenditure, such as taxes, housing costs and household bills.

The following table details how the typical London tenant’s working week is divided to pay for essential costs:

London Tenants Spending 70% of Their Income on Rent and Bills

Portico claims that it is not until 1pm on a Thursday that the average Londoner has earned enough to cover all of their essential expenses for the week. They are then left with around £201 of disposable income to be spent or saved as they like – although the firm notes that bills do not include food.

From 10am on a Tuesday until 4pm on Wednesday, Londoners are working to pay their rent, whereas all day on Monday, they work to pay their Income Tax and National Insurance.

Portico has also analysed the data on a borough-by-borough basis, adjusting the cost of rent, Council Tax and travel to zone 1 accordingly, but using the average London salary of £34,320 a year.

The agent found huge variations between boroughs; London tenants living in Bexley will have the greatest amount of disposable income left over after rent and essential bills, at £287 a week, while City of London workers have the least amount of disposable income, at £32. If tenants are looking to live in zone 1, Lambeth offers the highest amount of weekly disposable income, at £209.

The Managing Director of Portico, Robert Nichols, comments: “Londoners have to work increasingly later into the week before they start to spend some of their hard-earned money. Working for five hours alone to pay Income Tax, plus almost two days on rent, clearly shows how private rents in the capital have skyrocketed.

“But while rents are increasing, public transport is also improving significantly, so we’re seeing a huge number of tenants move further out to boroughs like Bexley, Barking and Dagenham, and Ealing to benefit from affordable rents, a quick commute – which will become even better with the arrival of Crossrail – and a good sum of disposable income in their pockets at the end of each week.”